sanjeri/E+ via Getty Images

Investment Thesis

Veeva Systems Inc. (NYSE:VEEV) helps streamline processes, improve collaboration, and ensure compliance with industry regulations.

The business is highly entrenched and returning to attractive growth once again. Furthermore, I make the case that paying 32x forward non-GAAP operating profits for Veeva is attractively priced.

Simply put, with more than 10% of its market cap made up of cash and with no debt, I believe that in the next twelve months, Veeva’s $231 per share will look like a bargain price. Here’s why.

Rapid Recap

Back in January, I wrote a bullish article, where I said,

The stock is far from blemish-free. For one, there are significant questions over its sustainable go-forward revenue growth rates.

On top of that, the previous 3 quarters have seen Veeva’s non-GAAP operating margins compress.

Despite these considerations, I declare that investors will in the next 12 months look back to $175 per share as an attractive entry point (but only in hindsight).

Author’s work on VEEV

Looking back, I was right to turn from neutral to bullish on VEEV. However, my timing wasn’t great. Incidentally, since I turned bullish on this stock, it’s up 7% versus the S&P 500 (SP500), which is up 15%. A significant underperformance on my part.

This is a reminder that at times, it’s important to be patient and stick with one’s original view, even if others are slow to adopt it. And that’s why I remain bullish on Veeva’s stock.

Why Veeva? Why Now?

Veeva provides cloud-based software solutions tailored specifically for the life sciences industry. Their platforms help pharmaceutical, and healthcare companies manage critical aspects of their business, including drug development and regulatory compliance.

Veeva’s fiscal Q4 2024 results exceeded their guidance with total revenue reaching $631 million, reflecting a resilient trajectory amidst prevailing macroeconomic challenges. Particularly noteworthy is Veeva’s sustained growth in its Development Cloud, which serves as a pivotal technology foundation for drug development. With a comprehensive suite of connected applications and a growing clientele, Veeva is positioned to capitalize on the increasing complexity of clinical trials.

Further, Veeva’s focus on clinical operations and data management underscores its resolve to enhance trial efficiency while mitigating costs. The significant adoption of Veeva’s solutions by top biopharma companies, coupled with the expansion of its regulatory and quality offerings, emphasizes Veeva’s evolving role as a leader in the life sciences software market.

Additionally, with the introduction of the Veeva Data Cloud’s Compass Suite, Veeva is striving to disrupt the commercial data market, offering innovative alternatives to incumbents like IQVIA (IQV).

However, Veeva faces headwinds, too. One notable challenge lies in the transition of its large customers to Vault CRM. While Veeva’s commitment to facilitating this transition underscores its dedication to customer satisfaction, the process entails significant investments in migration efforts, potentially impacting its profitability.

Given this background, let’s now turn to discussing its fundamentals.

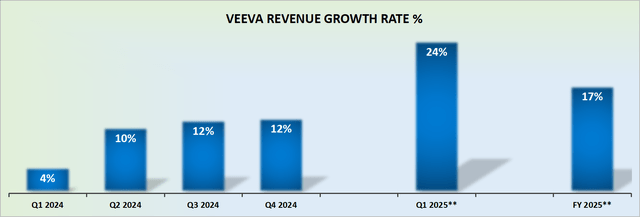

Revenue Growth Rates Expected to Deliver 17% CAGR

VEEV revenue growth rates

Veeva’s fiscal 2025, the current calendar year, should see its revenues headed towards 17% y/y CAGR. Given that we are still early in the year, the may be no room for a further 100 basis points of growth to emerge at some point.

But for my part, in an effort to err on the side of caution, I’ve presumed that 17% CAGR is all there is. Needless to say, these growth rates are high since fiscal 2024’s revenue growth rates were abnormally low given the contract adjustment that took place.

Consequently, the big question is what sort of growth rates should investors bank on for fiscal 2026? As Veeva’s operations once again normalize?

If investors were to get anything higher than 12% CAGR on the top line, I believe that Veeva’s valuation today is enticing. And that’s where we head next.

VEEV Stock Valuation — 32x Forward Non-GAAP Operating Profits

Veeva’s guidance points to $1.1 billion of non-GAAP operating profits, up more than 30% y/y from $843 million in the prior year.

Naturally, investors should not expect Veeva’s bottom-line profitability to continue outperforming its top-line growth at such a rapid pace going forward.

That being said, I believe there’s scope for Veeva’s fiscal 2026 (next calendar year), to continue growing its non-GAAP operating profits by approximately 25% y/y, as Veeva continues to scale and become more efficient.

On the other hand, this would put Veeva’s non-GAAP operating margins at 43%, which I imagine must be close to maxing out all the efficiencies and profitability out of this business.

Given all this, I believe that paying 32x forward non-GAAP operating profits makes sense. That’s simply the going price for such an entrenched and growing at-scale life science platform.

The Bottom Line

I believe Veeva Systems is an attractive investment due to its role in streamlining processes and ensuring regulatory compliance within the life sciences industry.

Despite concerns over its sustainable revenue growth rates, Veeva’s fiscal Q4 2024 results exceeded expectations, reflecting its resilience amidst macroeconomic challenges.

With a focus on its Development Cloud and the introduction of the Veeva Data Cloud’s Compass Suite, Veeva is poised for continued growth.

Therefore, Veeva’s expected revenue growth rates and valuation of 32x forward non-GAAP operating profits describe a compelling investment opportunity.