HTML tags cannot be rewritten as they are specific formatting elements used in web development. However, the rest of the content can be paraphrased.

LeChatNoir Investment Thesis: Sterling Infrastructure (NASDAQ: STRL) is a provider of infrastructure services, specializing in e-infrastructure solutions, transportation solutions, and building solutions. They offer a wide range of services, including infrastructure projects, concrete work, and projects in data centers, e-commerce distribution centers, and advanced manufacturing. Since its establishment in 1955, Sterling has acquired profitable subsidiaries that have expanded its reach. While based in Texas, Sterling operates primarily in the Southeastern and Northeastern United States, as well as the Mid-Atlantic and Rocky Mountain states.

Originally known as Oakhurst Company, Inc., Sterling Infrastructure was primarily focused on civil engineering. However, in recent years, the company has successfully acquired companies that have allowed it to enter new markets and seize new opportunities. The company’s stock price has grown by over 140% in the past year, and 2023 has been a particularly strong year for Sterling. In Q2 and Q3, the company achieved record-high earnings per share (EPS) with growth rates of 49% and 31% respectively. The industry as a whole has also experienced significant growth due to increased infrastructure spending, such as the Infrastructure Investment and Jobs Act.

Sterling’s three business segments, e-infrastructure solutions, transportation solutions, and building solutions, have all shown strong year-over-year (YOY) growth. Building and transportation solutions have experienced significant increases in Q3, with growth rates of 22.75% and 41.25% respectively. Although e-infrastructure solutions saw a YOY decrease in Q3, it is still up 9.4% annually. It’s important to note that some of this growth is due to price inflation rather than increased volume.

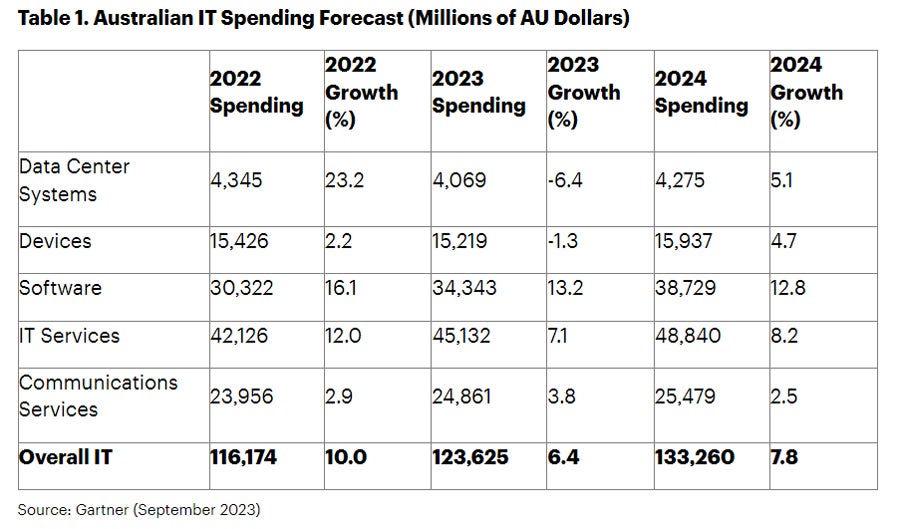

E-infrastructure solutions have been the fastest-growing part of Sterling’s business, driven by the demand for advanced manufacturing, data centers, and e-commerce distribution centers. The data center market, in particular, has been a major driver of growth. McKinsey & Company predicts that the demand for data centers will continue to grow at an annual rate of 10% until 2030. Advanced manufacturing, a priority for the National Science and Technology Council, will also contribute to Sterling’s growth.

Sterling’s transportation solutions business has been consistently reliable, and recent increased infrastructure spending has further boosted its revenue. The overall value of state and local government transportation contract awards has increased by 10% YOY, with a particular focus on highways. This has resulted in a record backlog for Sterling’s transportation solutions line of business.

Building solutions, which include concrete foundational building companies, have seen growth due to increased demand in residential and commercial real estate development. Sterling poured a record number of concrete slabs in Q3, primarily driven by increased residential demand. The acquisition of an Arizona concrete foundation business in 2022 has also contributed to growth. Sterling expects this segment to continue growing as demand for real estate increases.

Sterling has strong financials, with high cash reserves, low debt, and substantial accounts receivable. The company ended Q3 with $409 million in cash and $415 million in debt. Accounts receivable decreased by 10% YOY to $448 million, indicating improved collection rates. Sterling’s ability to finance acquisitions and grow without significant debt sets it apart from its peers.

Despite its impressive growth, Sterling’s stock is still undervalued compared to its peers. It has an EV/EBITDA of 10.11x, almost 19% lower than the sector average, indicating potential undervaluation. The company’s cash flow is also strong, with cash inflows of over $130 million in Q3, a 78.8% increase YOY. This suggests deeper value with a Price/Cash Flow of 5.97x, 52.42% below the sector average.

While undervalued stocks may not always reach their fair value, Sterling has shown promising growth and momentum, leading to a significant increase in share prices. The company’s projected earnings and track record justify this increase. Investors have confidence in Sterling’s value, but caution is advised due to the current high stock price.

Source link