dt03mbb

Short sellers are increasing their bets against the basic materials sector as uneven global demand and volatile energy prices continue to dampen investor sentiment into 2024.

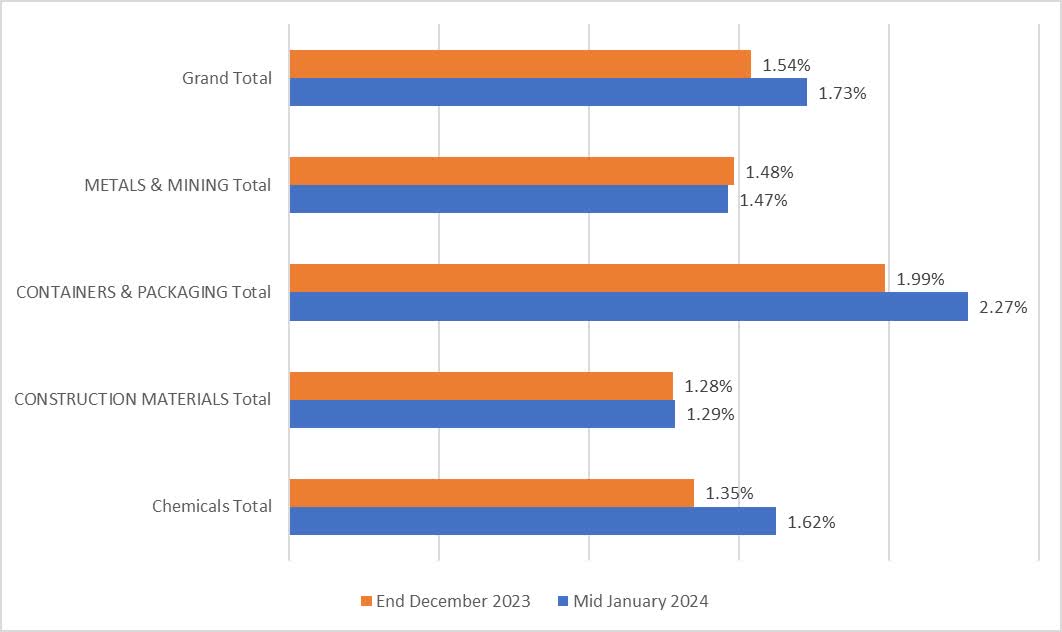

Average short interest across S&P 500 materials stocks increased 19 basis points, from 1.54% at the end of December 2023 to 1.73% of shares float in mid-January.

The S&P 500\’s Materials Select Sector SPDR Fund ETF (NYSEARCA:XLB) is down 2.7%, compared to the broader S&P 500, which climbed 2% from the start of the year.

Industry Analysis:

Average short interest as a percentage of floating shares

Containers & Packaging remains the most shorted industry within the materials sector with 2.27% short interest as of mid-January, up from 1.99% at the end of 2023.

Chemicals was the second most shorted industry within the sector with 1.62% short interest as of mid-January, compared to 1.35% from December 2023.

Construction Materials was the least shorted industry within the sector with 1.29% short interest as of mid-January, fractionally higher from December 2023.

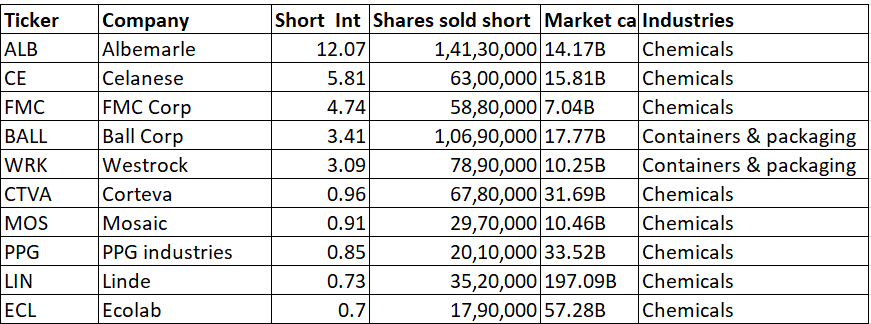

Stocks with the largest and least short positions.

Ranked by short interest as a percentage of shares float

Short interest for five of the index\’s biggest companies, Linde (LIN), Sherwin Williams (SHW), Air Products + Chemicals (APD), Freeport McMoran (FCX), and Ecolab (ECL) averaged 0.8% at the end of December.

Lithium miner Albemarle (ALB) is the most shorted in the sector at 12.07%, followed by Celanese (CE) and FMC (FMC) at 5.8% and 4.74% respectively, while Ecolab (ECL) is the least shorted stock at 0.7%.