deliormanli

Pharvaris (NASDAQ:PHVS) is in the process, phase 3 specifically, of developing a molecule that will be able to treat acute hereditary angiodema, as well as provide a prophylactic treatment to avoid severe episodes where HAE can cause asphyxiation. There is still quite a lot of work to be done, and we believe the available liquidity only covers a portion of R&D needs. Then there is moderate dilution in the company’s future as well. While the capital markets should improve in the interim, so we aren’t worried about acute liquidity problems, we still feel the valuation is full as getting a $2 billion market size, which is the TAM proposed by the company, requires us to consider the whole world’s incidence of HAE at pretty heft prices per patient. Considering that Pharvaris’ oral treatment, while practical, will not always be the most appropriate, the ambitious market sizing in our view makes PHVS fair value at best. Pass.

Innovation and product

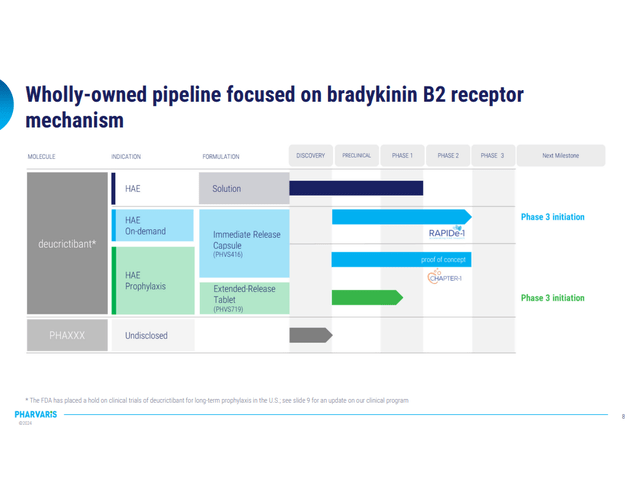

Pharvaris is a company which is in the clinical phases of making pretty straight forward product, simple and reliable. The trials were on clinical hold for a year, but since June 2023 they have resumed enrollment and Phase 3 is underway.

Phase 3 (Corporate Pres 2023)

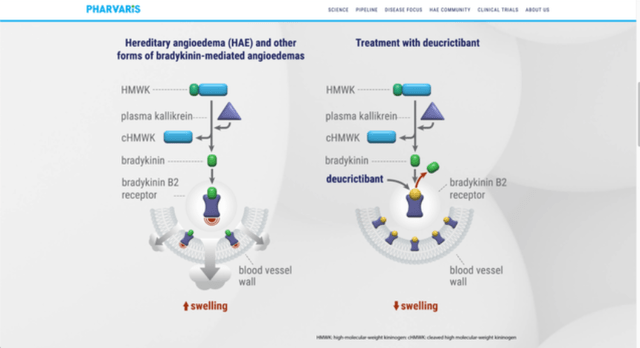

The product is called Deucrictibant and it is a direct B2-receptor antagonist. The market is people who are suffering from Hereditary angioedema (HAE), a disease which occurs as a problem of C1-inhibitor protein (either lack of it, or production of a dysfunctional protein). This disease is quite unpleasant from patients’ perspective. Due to uncontrolled activity of plasma kallikrein molecule, because of the C1-inhibitor problem, excessive amount of molecule in the pathway, bradykinin, has been accumulated, which then leads to painful swelling of multiple tissues in our body.

HAE can be potentially life-threatening, due to the swelling and therefore blockage of air pathways. That’s one of the reasons why this disease should be treated as soon as possible. In that manner, oral B2-receptor antagonist which Pharvaris made seems to be good solution for the problem, especially if we want to avoid injection pathway of administration, which tends to be only approach. Its mechanism of action is by blocking attach site of bradykinin at the B2-receptor, therefore blocking bradykinin to cause symptoms of the disease. Due to the simplistic action mechanism it is pretty obvious what the drug can do so it would be reasonable to hope for a more straightforward clinical trial.

They are offering two main treatments for HAE through oral application: On-demand treatment and Prophylactic treatment. As the name suggests, on-demand treatment is for attacks that have already occurred, by administering the capsule which has an immediate-release effect. Prophylactic treatment’s aim is to prevent occurrence of the attack, so for that purpose they made extended-release tablet, which goal is to maintain therapeutic levels of the product in the plasma for longer period of time (up to 72 h) so less frequent administration would be needed.

For both treatment approaches, the company claims that their product shows more effective results, with less dosage concentration needed compared to few other oral products which are currently in use.

Mechanism (Pharvaris Website (pharvaris.com))

Financial Comments

This product isn’t very complex, these antagonists have been used in the past, and we feel that there should be a market for this more practical solution. However, the market may still be too small considering current market caps. We have a burden in the US of around $44k per person annually, taking into account the various severities of HAE. Due to the rarity of the disease, affecting only a few thousand people in the US, the market sizing only get to around $320 million in the US. In Europe, with double the population, but half the per capita costs, we estimate about a $320 million market for Europe as well, getting us to a total of $640 million. The whole developed world is probably around $900 million conservatively, including Japan and others. Including the whole world and using European and US prevalence rates, we get around $2 billion in market for HAE, assuming an average $10k annual disease burden.

With the market cap at around $1.45 billion for Pharvaris, that might sound quite attractive, but their drugs are in phase 3 which means still a pretty large outstanding burden to finalize the drugs. Phase 3 is the most complex phase, and probably around only halfway done for the trial if being generous. That means the burden outstanding, assuming a lot of savings between the slow release and immediate release mechanisms in research expense, is going to be large, probably around half of the $2 billion rule of thumb for developing

Source link