Leon Neal

Intel Unveils New Financial Reporting Framework

Intel Corporation (NASDAQ:INTC) investors have fared poorly against the S&P 500 (SPX, SPY) since the start of 2024, delivering a YTD total return of -12%. In addition, INTC has underperformed the market since I urged a sanity check on INTC in my previous article in early January 2024. I downgraded INTC to a Hold even as my previous bullish thesis panned out accordingly. With INTC assessed to have formed a bottom at the $40 level last week, should Intel investors consider returning to buy its recent underperformance, anticipating a more robust recovery ahead?

Intel management unveiled its revised financial reporting framework for its foundry and products business in a conference on April 2. While the overall profitability targets have remained the same, Intel aims to provide further clarity into the margin trajectory of its underlying businesses and instill more robust operating and financial discipline in its business units. As a result, management believes the revised framework should provide investors with a clearer picture of Intel Foundry’s growth drivers as it looks to regain process leadership against pure-play foundry leader Taiwan Semiconductor Manufacturing Company Limited aka TSMC (TSM).

In addition, Intel also shared recast financial statements into the health of its foundry business, and it didn’t look pretty. The company disclosed that Intel Foundry recorded a segment loss of $7B in 2023, “widening from $5.2 billion in 2020.” Furthermore, Intel Foundry also suffered a revenue decline of 37% last year, falling to $18.9B.

Therefore, I assessed that the market was likely stunned by the weak performance of Intel Foundry, even as the company attempted to shore up investor confidence about its long-term roadmap through 2030. Accordingly, INTC fell more than 4% in after-market trading. With INTC dropping closer to its $40 support level. Should investors consider adding INTC more aggressively as CEO Pat Gelsinger and his team work to rejuvenate Intel’s fortunes and reinstate its previous glory as the King of semis?

Intel Foundry Key To Margin Accretion

Intel management highlighted an aggressive roadmap, targeting an adjusted gross margin of 40% for Intel Foundry by 2030. In addition, Intel believes its foundry business can deliver an adjusted operating margin of 30% by the end of the decade. As a result, investors should contemplate breakeven profitability between now and 2030, with management confident of achieving the metric in the “next few years.”

However, it’s critical to note that Intel’s disclosure has not altered its overall roadmap of achieving an adjusted gross margin of 60% and an adjusted operating margin of 40% at the corporate level by 2030. Therefore, while the revised financial reporting framework allows deeper scrutiny of Intel Foundry’s accountability, I believe the main re-rating factor will likely be driven by its ability to execute.

Intel management has confidence that as it transitions into Intel 18A, it should alleviate cost pressures and improve operating and scale efficiencies as it garners more orders. Bolstered by the use of EUV lithography, Intel aims to narrow the tech and TCO gap with TSMC. In addition, Intel management highlighted that the company aims to reduce its foundry outsourcing to 30% over time as Intel Foundry ramps. With Intel Foundry currently posting “negative gross margin, particularly due to start-up costs and wafer margins at 0%,” the opportunity for growth seems substantial if Intel can execute well.

Intel’s Momentum Remains Robust

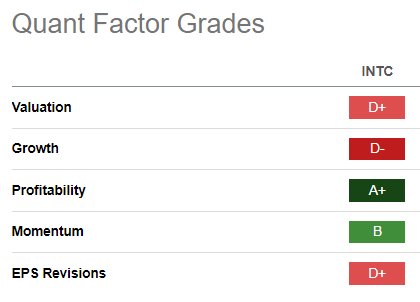

INTC Quant Grades (Seeking Alpha)

With INTC rated with a “D+” valuation grade, Intel bears could argue that INTC doesn’t seem attractive, given the immense execution risks attributed to the ramp of Intel Foundry.

Despite that, Intel’s best-in-class “A+” profitability grade should bolster the confidence in its fundamentally strong business model as it looks to close the gap with TSMC. Moreover, INTC’s “B” momentum grade augurs well with my thesis that the worst in INTC’s selling intensity is likely over. As a result, investors can consider buying steeper pullbacks into well-supported zones over time, lifting their exposure progressively.

Is INTC Stock A Buy, Sell, Or Hold?

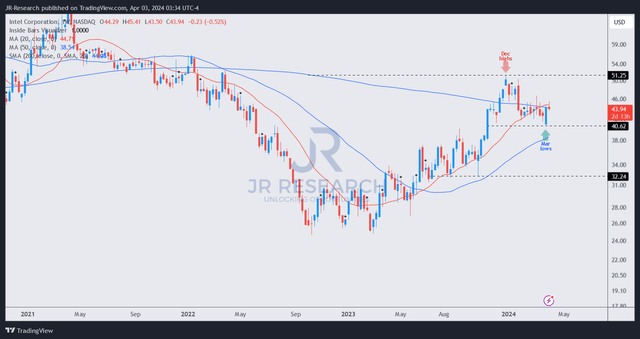

INTC price chart (weekly, medium-term, adjusted for dividends) (TradingView)

I gleaned robust support at INTC’s $40 zone as buyers returned aggressively to prevent a steeper selloff last week. While the adverse post-market reaction on April 2 suggests most of last week’s recovery could dissipate, it should be seen as an opportunity for high-conviction investors to buy more INTC shares.

Investors must follow Intel Corporation’s momentum, which has remained highly constructive. This suggests the market is still confident about growth opportunities from Intel Foundry as a vital player in driving potential margin accretion through 2030.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.