We have extensively discussed the various changes that big data has brought to the financial industry. In a previous post, we highlighted the major benefits of utilizing financial analytics to streamline financial processes. Another significant advantage of big data is its impact on investment planning. Read on to learn more.

What Are the Benefits of Big Data for Investment Planning?

The market for big data in finance was valued at $37 billion last year and is projected to grow at a rate of 5% per year. One of the key drivers of this growth is the increasing reliance on big data for investment purposes.

In the rapidly evolving financial landscape, the use of big data in investment planning has become increasingly crucial. As we navigate through the complexities of the market, leveraging big data can provide a substantial advantage to both individual and institutional investors. They are turning to data-driven investment strategies to achieve the highest return on investment while minimizing risk.

Especially when considering tech investment trusts, which are at the forefront of technological advancements, the integration of big data can be a game changer. In this article, we will delve into the definition of big data, its different types, the challenges it presents, and how it can be effectively utilized in investment planning.

Definition of Big Data

Big data refers to the vast volumes of data generated every second from various sources such as social media, transaction records, and IoT devices. This data is characterized not only by its size but also by its variety, velocity, and veracity.

In the context of investment, big data encompasses market data, financial records, consumer behavior, and more, providing a comprehensive view of the investment landscape.

Types of Big Data

When discussing big data in the context of investment planning, it is important to recognize that not all data is created equal. Big data can be classified into three primary types: structured, unstructured, and semi-structured. Each type has its unique characteristics and implications for investment strategies.

Structured data is highly organized and formatted in a way that makes it easily searchable and analyzable. This type of data is typically stored in traditional database systems. In the realm of investment, structured data includes stock market prices, financial statements, and economic indicators.

These datasets are invaluable for quantitative analysis, allowing investors to run statistical models and identify clear patterns and trends. For instance, structured data can be used to analyze the performance of tech investment trusts over time, comparing various metrics such as return on investment, market capitalization, and dividend yield.

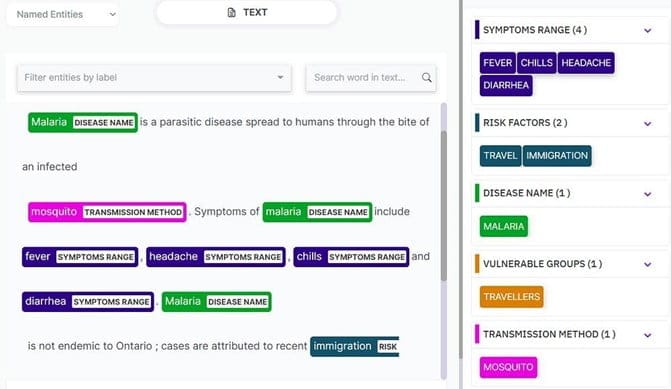

On the other hand, unstructured data is not organized in a predefined manner and is often text-heavy. Examples include news articles, social media posts, video content, and audio recordings. This type of data provides qualitative information that can offer insights into market sentiment, emerging trends, and consumer behavior.

In the context of tech investment trusts, unstructured data can be mined for insights into public perception of technology sectors, potential regulatory impacts, and the overall market mood. Analyzing unstructured data requires advanced techniques such as natural language processing and sentiment analysis to extract meaningful information that can inform investment decisions.

Semi-structured data falls between structured and unstructured data. It is not organized in a strict tabular form like structured data, but it does have some organizational properties that make it easier to analyze than purely unstructured data. Examples include XML files, JSON, and emails.

In investment planning, semi-structured data can be particularly useful for analyzing communications, reports, and documents that contain both quantitative and qualitative information. This type of data can provide contextual insights that structured data alone may miss, such as the nuances in a CEO’s statement or trends in consumer complaints and reviews.

Understanding these three types of big data is crucial for investors looking to leverage this resource effectively. By combining insights from structured, unstructured, and semi-structured data, investors in tech investment trusts can gain a more holistic view of the market, allowing for more informed and strategic decision-making.

Applying Big Data to Investment Planning Processes

In the realm of investment planning, especially when considering tech investment trusts, the application of big data can revolutionize decision-making processes. By integrating diverse data sets into investment strategies, investors gain a more nuanced and comprehensive understanding of the market.

Here’s how big data is transforming investment planning processes:

1. Data-Driven Market Analysis:

Big data enables a more thorough and multifaceted market analysis. By analyzing large volumes of structured data, such as market trends and financial reports, investors can uncover patterns and correlations that might be invisible to the naked eye. For tech investment trusts, this could involve examining technology sector performance under varying economic conditions or understanding how different tech companies’ stock prices react to global tech trends.

Predictive modeling is one of the most powerful tools in big data analytics. Using historical data, machine learning algorithms can forecast future market trends and investment outcomes. This aspect is particularly crucial for tech investment trusts, where rapid changes in technology can have significant impacts on investment performance. Predictive analytics can help identify potential growth areas in tech or foresee market downturns, allowing investors to adjust their strategies accordingly.

Unstructured data, such as news articles, social media feeds, and blog posts, can be analyzed for sentiment analysis. This process helps gauge public opinion and market sentiment towards specific technologies, companies, or the tech sector as a whole. For instance, rising positive sentiment in a new technology could indicate a potential investment opportunity for a tech investment trust.

Big data also plays a critical role in risk management. By analyzing vast amounts of data, investors can identify potential risks more effectively. This includes market risks, credit risks, and operational risks. In the context of tech investment trusts, this could mean assessing the risk of investing in emerging technologies or understanding the impact of regulatory changes on tech companies.

2. Personalized Investment Strategies:

Big data allows for the creation of personalized investment strategies. By analyzing individual investor behavior, preferences, and risk tolerance, investment plans can be tailored to meet specific investor needs. For tech investment trusts, this might involve suggesting a specific portfolio mix that aligns with an investor’s interest in certain tech sectors or their appetite for risk.

3. Real-Time Decision Making:

The real-time processing capabilities of big data tools mean that investors can make decisions based on the most current information available. This is especially critical in the fast-moving world of technology investments, where market conditions can change rapidly.

Advantages & Disadvantages of Using Big Data for Investment Planning

Advantages:

1. Enhanced Decision-Making: Big data provides a wealth of information, enabling investors to make more informed and data-driven decisions.

2. Predictive Insights: Leveraging historical and real-time data, big data analytics can forecast market trends, benefiting investment strategies, especially in volatile tech sectors.

3. Risk Management: Identifying and analyzing potential risks becomes more efficient with big data, contributing to more robust investment planning.

Disadvantages:

1. Data Overload: The sheer volume of data can be overwhelming, leading to analysis paralysis or misinterpretation of data.

2. Cost and Complexity: Implementing and maintaining big data systems can be costly and require specialized expertise.

3. Data Security and Privacy: Managing large datasets raises concerns about data breaches and privacy, particularly sensitive financial information.

Bottom Line

Incorporating big data into investment planning, especially in tech investment trusts, offers a strategic advantage in today’s data-driven world. While there are challenges to its implementation, the benefits of enhanced decision-making and predictive analytics are significant. As the financial world continues to evolve, big data will play an increasingly integral role in shaping investment strategies.

Source link