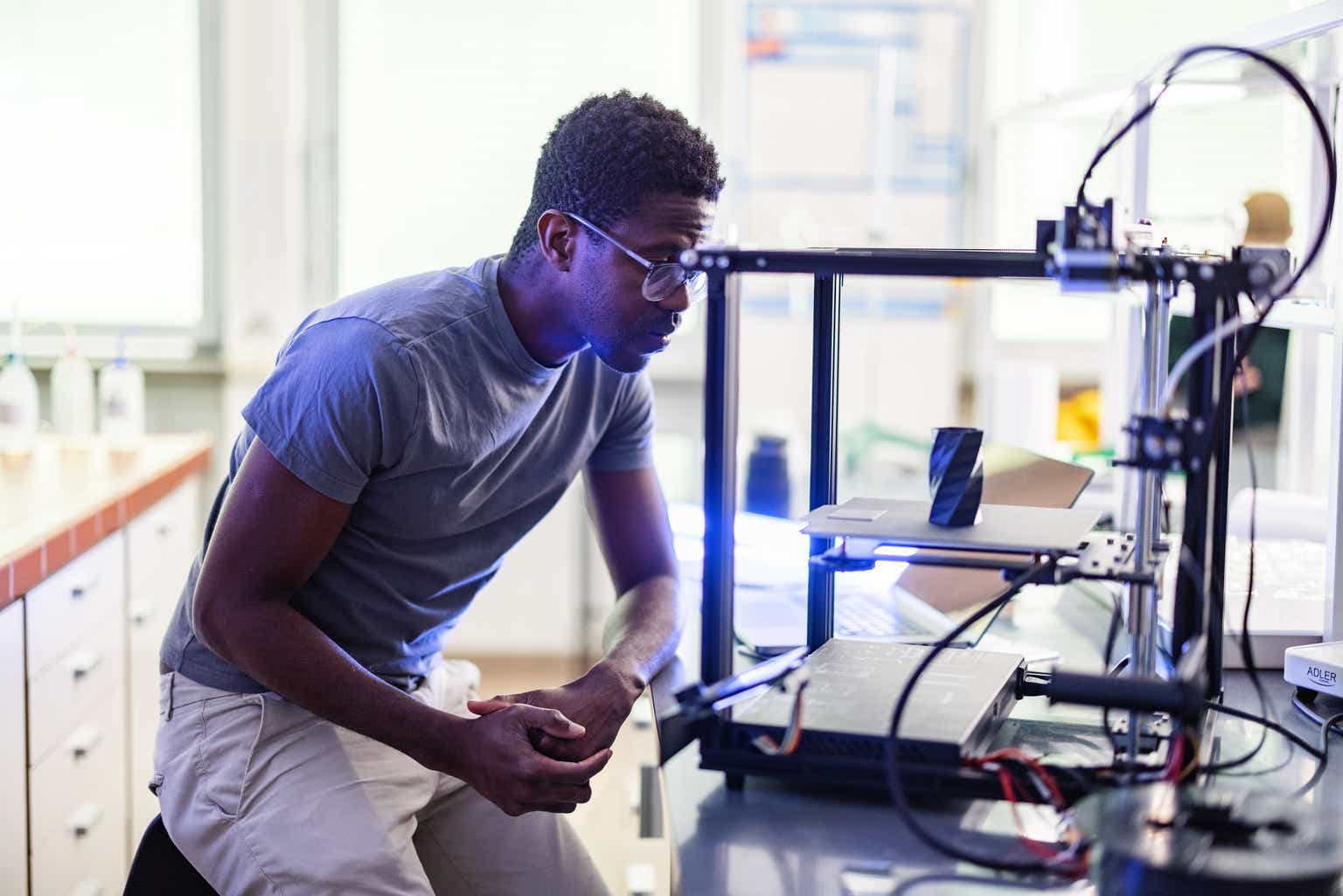

Guest: Bruno Caratori is the co-founder & COO of Hashdex, a global crypto asset manager that launched the first crypto index ETF in the world. Hashdex also runs the spot Bitcoin ETF, DEFI.

Recorded: 1/10/2024 | Run-Time: 38:43

Summary:

In today’s episode, we’re talking all about the SEC’s recent spot Bitcoin ETF approval with someone from one of the 11 companies in the Bitcoin ETF race. And in crypto fashion, the approval actually happened halfway through our episode! Bruno talks about what a wild week it was with the fake announcement by someone who hacked the SEC’s Twitter account. Then he shares the unique structure he created for their ETF (DEFI) and some year-end crypto predictions.

Comments or suggestions? Interested in sponsoring an episode? Email us Feedback@TheMebFaberShow.com

Links from the Episode:

1:32 – Welcome Bruno to the show

3:06 – The Bitcoin ETF approval

7:22 – The enthusiasm surrounding a Bitcoin ETF

9:02 – Introducing Hashdex & DEFI

19:22 – The significance of crypto-native companies running the Bitcoin ETF

30:26 – Forecasting the crypto market in 2024

37:19 – Delving into Bruno’s most controversial viewpoint

39:57 – Reflecting on Bruno’s most notable investment

Learn more about Bruno: Hashdex; Twitter; LinkedIn; Instagram

Transcript:

Welcome Message:

Welcome to the Meb Faber Show, where the focus is on helping you grow and preserve your wealth. Join us as we discuss the craft of investing and uncover new and profitable ideas, all to help you grow wealthier and wiser. Better investing starts here.

Disclaimer:

Meb Faber is the co-founder and chief investment Officer at Cambria Investment Management. Due to industry regulations, he will not discuss any of Cambria’s funds on this podcast. All opinions expressed by podcast participants are solely their own opinions and do not reflect the opinion of Cambria Investment Management or its affiliates. For more information, visit cambriainvestments.com.

Meb: Welcome, everybody. Fun episode today. Our guest is Bruno Caratori, co-founder and COO of Hashdex, a global crypto asset manager. In today’s episode, we’re talking all about the SEC’s recent Spot Bitcoin ETF approvals with someone from one of the 11 companies in the Bitcoin ETF race. And, in crypto fashion. The approval actually happened halfway through our episode. Bruno talks about what a wild week it was with, a fake announcement by someone who hacked the SEC’s Twitter account, then he shares the unique structure he created for their ETF ticker, DEFI, and what his prediction is for total assets in Bitcoin ETFs by the end of the year. PS listeners, after seven years of the podcast, and tens of millions of downloads, you now don’t have to hear about my 2013 tweet saying I’d bet a sushi dinner on when the Bitcoin ETF gets approved. The day has finally come. Kanpai. Please enjoy this episode with Bruno Caratori.

Meb: Bruno, welcome to the show.

Bruno: Meb, thank you so much for having me. It’s a pleasure to be here.

Meb: Last time, we hung out having some Asian food in New York City, some drinks, talking about one day in the future where we might have some Bitcoin ETFs trading in the markets, everything going on in that world. Where do we find you now? Are you in New York City?

Bruno: I’m in New York City, Meb, and I’ll tell you, I don’t exactly recall when that was. Things have been moving a lot faster than I ever thought they would, and I’ve been in crypto for over six years now, with Hashdex, and for several years prior to that. So, what we’re going through right now, Meb, is indeed pretty unique. We’re on the cusp of seeing some things.

Meb: It feels like New Year’s Eve; the clock is finally getting to close to midnight. It’s been a long wait. Long time listeners of the podcast know I have a 2013 tweet. People were talking about a Bitcoin ETF back then, and I said, “There’s no way a Bitcoin ETF is making it to market this year. I’m willing to bet anyone dinner. I prefer sushi,” and then I’ve just retweeted that every year. Until, the last year. I said, “All right, it feels like we’re close.” So, given that we’re recording this Wednesday, January 10th, which is the potential day before the Kentucky Derby starts, give us a little update, because it’s been, in the most crypto way possible, being a drama queen. We got Twitter accounts getting hacked, everyone following every filing, which I don’t think anyone has ever done in the history of filings. No one reads these. Give us an update. What’s going on in your world?

Bruno: I will comment on some of the things that I think have not happened before in US, and maybe even Global Capital Markets, Meb, but as we speak, this is the afternoon of January 10th, right? This is a date that folks have been waiting for a long time. This is the final decision date for one of the Spot Bitcoin ETF applications, which is ARK and 21Shares. Supposedly, the SEC is required to give a final answer to a rule change proposal that would allow, ultimately, Bitcoin ETFs. We’re all expecting this to happen within the next few hours. What is interesting is that, with everyone, issuers, and everyone who’s following this are getting signals that the SEC will blanket approve all 12 or so ETF issuers seeking to launch a Spot Bitcoin ETF. So, they will not only call a decision on the ARK 21Shares, but, as I believe most of your audience has heard, the likes of BlackRock and Fidelity and Franklin, Invesco, they’re all in this race, too; and, there’s the odd horse in this race, which is Grayscale, which is navigating in its own track, because, in a way, they’re the folks who have caused a good amount of this. But, this is what we’re all expecting now. I don’t think people have followed that closely the nuances of an ETF approval, what a 19b-4 is, and what making a registration statement effective is, but now, there’s almost a minute-by-minute play on what happens next, the audience has probably seen this, too, to make this entire process either more interesting or more memorable depending on how you look at it. Yesterday, the official SEC account tweeted that the ETF had been approved, which everybody felt was really odd. We at Hashdex were having our own internal meeting about our Spot ETF application. I imagine a bunch of the issuers were going through similar processes: “What the heck is going on? Since when did SEC issues approval orders through Twitter? But, I guess this is real. How should we react to this?” And, only a few minutes later, Gary Gensler comes out saying, “The official account was compromised. No ETFs were approved,” at which point we all throw our hands in the air and we’re like, “Oh, my God, what’s happening? Even the SEC is not able to use two-factor authentication in their account and do their part in protecting investors.” That’s how exciting and unusual the last several hours have been, Meb.

Meb: Assuming this happens; today, tomorrow, next week; but, it seems like all signs point to it being imminent. It could happen on this podcast. After the close, which is about 10 minutes from now, we’ll check back. What’s the significance? Give us a little step back macro view of the world. Why is everyone so excited about this? Bitcoin and crypto, ETFs and funds, and fund variants have certainly been around, not just variants in the US, not Spot, but other countries around the world have certainly been able to invest in these through traditional custodians like Coinbase and elsewhere. Why is everyone so excited about this? What’s the significance? And then, at the end of this, I want to hear the prediction, year one, Bitcoin ETF, AUM, Spot in the US end of 2024.

Bruno: I’ll try to give you that range, but Meb, I think there’s so many layers to this significance. We discussed this a lot internally, because it informs how we talk to our clients, but even, it informs our company strategy. But, at first layer, the significance is that US investors will finally have access to a fully regulated product that gives them exposure

Source link