Mohammed Haneefa Nizamudeen

Edwards Lifesciences (NYSE:EW) announced their Q3 FY23 results on October 25th. They delivered a 10.9% organic revenue growth, as the market expected, and reiterated their full-year guidance. Their recent strong trial data releases reinforced my confidence in their $10 billion revenue opportunity by 2028. I maintain my ‘Strong Buy’ rating with a $83 target price.

Clinical Trials Updates

On October 25th, 2023, Edwards Lifesciences released their five-year data from the Partner 3 Trial, demonstrating excellent survival rates for patients receiving the SAPIEN 3 valve. The five-year data indicates that all-cause mortality was 10%, cardiovascular mortality was 5.5%, and disabling stroke was 2.9% at five years. As Larry Wood, Edwards’ Corporate Vice President, stated: ‘The SAPIEN 3 valve has demonstrated 99% freedom from death and disabling stroke at one year, 90% survival at five years, and is the only valve with a THV-in-THV indication.’

In my opinion, the five-year data of SAPIEN 3 demonstrates the technological advancement of Transcatheter Aortic Valve Replacement (TAVR) with the SAPIEN platform. As I pointed out in my initiation article, the SAPIEN platform is crucial for Edwards Lifesciences’s future growth. It’s worth noting that Transcatheter Aortic Valve Replacement represents 65% of the group’s revenue, and the innovation of SAPIEN maintains Edwards Lifesciences’s dominance in the structural heart area.

During the Q3 FY23 earnings call, their management also expressed their intention to present a six-month analysis of their EVOQUE tricuspid valve, the first-of-its-kind therapy for tricuspid valve disease. Additionally, they are going to release the one-year full cohort results of the CLASP IID pivotal trial with PASCAL. The PASCAL system represents an innovation for degenerative mitral regurgitation.

In summary, I am excited about all these clinical trials and data presentations, which prove Edwards Lifesciences’s continuous innovation in the structural heart space with market-leading technologies.

Q3 FY23 Review and Outlook

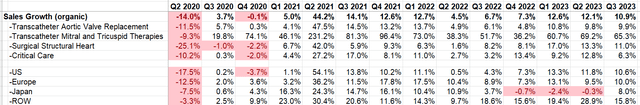

Their Q3 results met market expectations, and they reiterated their full-year guidance. They achieved a 10.9% organic revenue growth and maintained the full-year 2023 financial guidance of 10 to 13% constant currency sales growth.

EW Quarterly Results

Their adjusted gross margin dropped from 81% in Q3 FY22 to 76.4% in Q3 FY23, primarily due to foreign exchange factors. They have maintained their full-year gross margin guidance at 76-78%. Regarding cash flow, they have reiterated their guidance of $1 billion to $1.4 billion of free cash flow for the full year. Overall, there hasn’t been significant change in the outlook for this quarter. There was no guidance raise this quarter, which, in my opinion, disappointed the market a little bit. However, I believe their remarkable double-digit top-line growth, coupled with a strong pipeline and data releases, is noteworthy.

They maintain a very strong balance sheet, with $1.9 billion in cash and equivalents, and they are in a net cash position.

Their management pointed out that the company grew faster than the overall procedure growth in Q3, and they are confident about achieving $10 billion in revenue by 2028. This indicates a compound annual growth rate of 10.8% from 2022 to 2028. I find the growth projection reasonable for several reasons. Firstly, Edwards Lifesciences delivered an average annual organic revenue growth

Source link