Ceri Breeze

Citigroup (NYSE:C) recently released their annual report and it was 313 pages long. This thing looks like a college textbook.

Frankly, coming into Q1 ’24 earnings, the banking and financial services sector seems to be in pretty good shape from a credit perspective, with the possible exception of the regional banks and the commercial real estate issues, but net interest income should be stable to higher, net interest margins (NIM) should be stable, loan losses contained, and with the prospect for Basel III regulatory reform cooling (maybe due to the election year) it seems like some of the regulatory fervor has diminished.

One metric checked monthly is credit card losses, since credit cards are unsecured credit. In March ’24, Citi, JPMorgan (JPM) and Bank of America (BAC) reported lower losses for February ’24 credit card vintages, with some of the other metrics a little worse.

The point is that this “unsecured credit” metric is still not raising a red flag (yet).

Citigroup:

The thing that caught my eye for Citi is that they face progressively easier comps as they move through 2024. Here’s the actual EPS progression for Citi from Q1 ’23 through Q4 ’23:

Q1 ’23: $2.19 Q2 ’23: $1.33 Q3 ’23: $1.53 Q4 ’23: $0.84

Here’s what’s currently estimated for quarterly EPS for Citi for 2024:

Q1 ’24: $1.20 Q2 ’24: $1.49 Q3 ’24: $1.56 Q4 ’24: $1.40

Obviously Q1 ’24 is the toughest comp for the bank, but for the full year ’24 Citi is currently expected to earn $5.70 in EPS vs. actual EPS of $5.88 in 2023.

What’s muddied the waters is the consumer banking divestitures that have occurred in India, Taiwan, the Philippines, and even Korea. I believe these are still carried on Citi’s financials as “legacy businesses” so 2023 and 2024 may not be apples to apples so to speak.

When Citi reports Friday morning, April 12th, before the opening bell, Street consensus is looking for $1.20 in EPS on $20.4 billion in revenue for “expected” YoY growth of -45% and -5% respectively. The first quarter of ’23 is a tough comp for the bank giant.

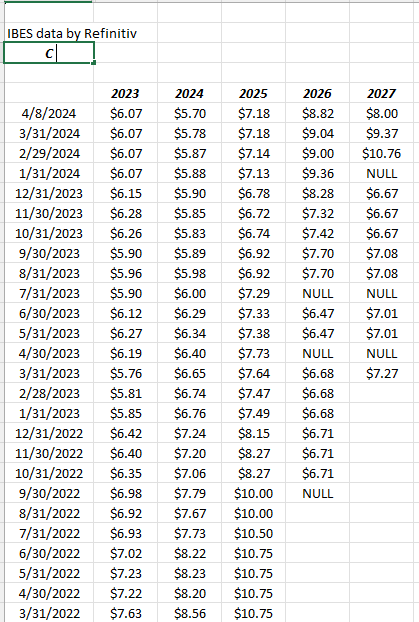

EPS estimate revisions:

Source: LSEG

It’s a little worrisome that the 2024 EPS estimate is still declining, albeit at a slower pace since 12/31/23, but the 2025 and 2026 EPS estimates continue to rise.

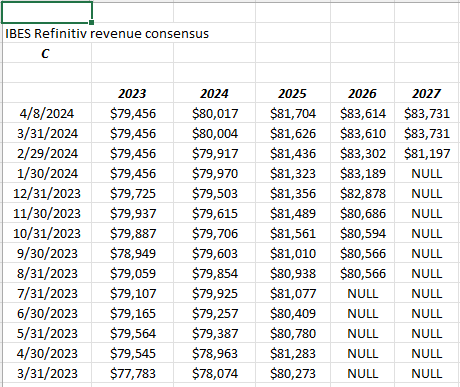

Revenue estimates revisions:

Source: LSEG

Frankly, the 2024-2026 revenue revisions are slowly working higher, which is a positive for the bank giant.

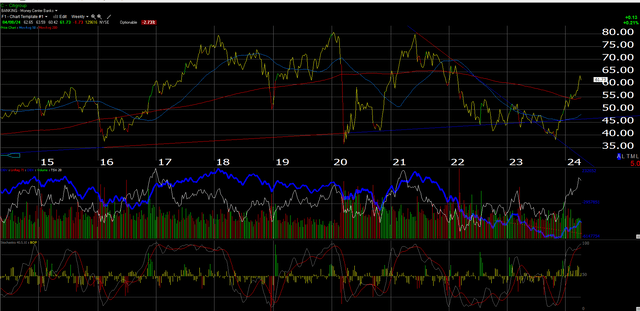

Technical analysis:

What’s fascinating to me about this weekly chart from Worden is that Citi has run up to the $80 level 3 times from 2018 to 2021, only to come back down and bottom around the $40 level the last two of those rallies.

The stock is headed higher again, although it’s overbought. A pullback to $50-55 would be perfect.

Here’s how Citi has performed relative to the S&P 500 since the mid 2000s:

2005: -8% vs. +10.19% 2010: 5.86% vs. 13.49% 2015: 5.12% vs. 12.85% 2020: -1.44% vs. 13.77% 2024 Q1: 24.11% vs. 10.56%

Performance returns sourced from YCharts

Valuation: The value investors that have been talking about the stock for years always point to the price to book value and price to tangible book value of Citi, which at $61 per share is 0.65x and 0.75x, which is pretty cheap for a bank giant like Citi.

Citi’s problem is ROE which – at 7% – is less than half that of JPMorgan and Bank of America’s ROE.

Jane Fraser is dealing with that problem by selling some of these underperforming segments.

In this blog’s earlier previews and summaries of Citi’s earnings, we discussed these issues here, and here.

At 9x average EPS per share, Citi is expected to grow EPS (3-year average) by 15% in the next three years, and expected to average 2% revenue growth.

The stock is currently trading at a significant multiple discount to its expected growth rate, but the near-term issue might be how 2024 materializes.

Summary/conclusion: Citi (the stock) is off to a great start in Q1 ’24, given the stock’s first quarter performance vs. the S&P 500. Jane Fraser has finally downsized the business to some extent, but we need to see the various Citi businesses generating sufficient returns.

The banking business (presumably investment banking) is down to 5% of Citi’s revenue today, while Wealth and US Personal Banking is 38% of total revenue. The TSS business (Treasury and securities services) has been roughly 25% of revenue the last 5 quarters, and was one of Citi’s better-performing segments.

Some of the segment analysis is a bit of a mess given all the divestitures and the bleeding off of some businesses, so hopefully the reporting improves as of the end of ’24.

Clients are long a 1.2% position in the stock, and more will be bought on a pullback. JPMorgan remains clients #1 financial holding, so owning Citi is a nice value play to balance JPMorgan’s momentum.

If Citi could be summed up in one sentence today, I’d say Jane Fraser is trying to transition Citi from a “cheap on a book value basis” to a bank that is “cheap on a PEG (or P/E to growth) basis.”

We’ll see.

None of this is advice or a recommendation. Past performance is no guarantee of future results. Investing can involve loss of principal even for short periods of time. This information may or may not be updated, and if it is updated, it may not be updated in a timely fashion. All EPS and revenue data is sourced from LSEG or the previous IBES data by Refinitiv.

Thanks for reading.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.