Yuri_Arcurs/E+ via Getty Images

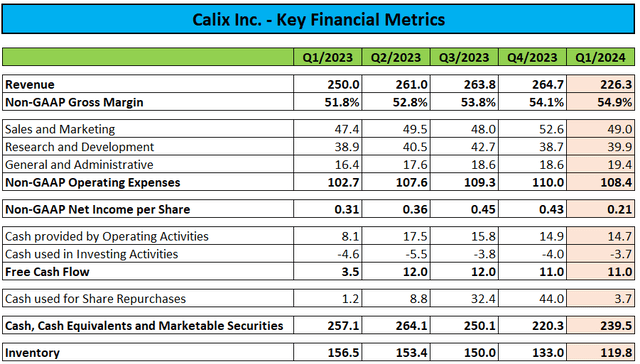

On Monday, Broadband services platform provider Calix, Inc. or “NYSE:CALX” reported Q1/2024 results in line with the guidance provided by management in the Q4/2023 stockholder letter:

Regulatory Filings

While revenues and profitability were down both sequentially and year-over-year, gross margins reached new all-time highs.

In addition, the company continued to generate solid free cash flow and finished the quarter with $239.5 million in cash, cash equivalents and marketable securities. Calix continues to have no debt.

Following aggressive share buybacks in the second half of FY2023, repurchases slowed down to $3.7 million in Q1.

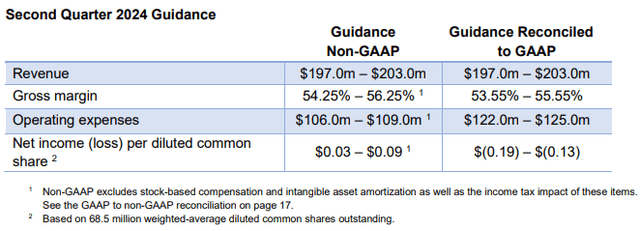

However, the company’s guidance for Q2 came in well below consensus expectations for a second quarter in a row:

Q1 Stockholder Letter

At the mid-point of the provided top line range, Calix will miss analyst expectations by almost 15% with profitability also falling well short of the $0.24 consensus estimate.

While management had warned investors of temporary headwinds in the company’s appliance business, they apparently underestimated the magnitude of the impact.

(…) The appliance (hardware systems) portion of our business continues to be challenged by three main factors.

The first is the continued indecision by our customers regarding whether they apply for BEAD or other governmental funding sources.

The second is the shortening of lead times to our customers, which has the effect of reducing the amount of customers’ inventory while at the same time limiting our visibility.

Third, there is a set of customers that have extended the evaluation of their spending plans into the second quarter of 2024 or have changed their investment priorities for 2024 to concentrate on adding new subscribers in existing network builds versus continuing to aggressively build new networks.

We believe each of these factors will resolve themselves over the course of this year.

Please note that management previously expected Q1 to mark the low point for the year, with revenues growing sequentially thereafter.

However, the new stockholder letter is lacking a statement regarding the company’s anticipated revenue trajectory for the balance of 2024, which doesn’t exactly bode well for the second half of the year.

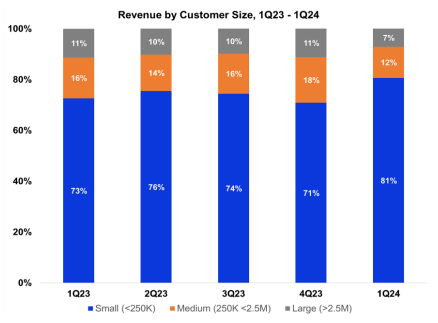

Particularly, the company’s medium-sized and large customers held back on purchases:

Revenue from medium-sized customers was 12% of revenue in the first quarter of 2024, down from 18% in the prior quarter, and decreased 41% in absolute dollars due primarily to a couple of significant customers in this category reducing their purchases.

Revenue from large customers was 7% of revenue for the first quarter of 2024, down from 11% in the prior quarter, and down 46% in absolute dollars from the fourth quarter of 2023. The decrease was primarily due to a customer continuing to evaluate their purchase plans for new network builds.

Stockholder Letter

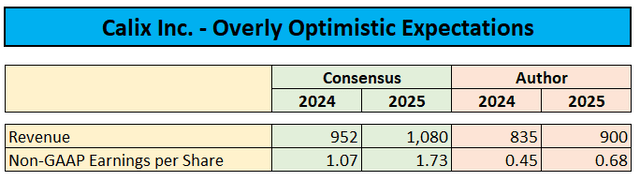

For my part, I do not expect this pattern to reverse in the second half of the year. If true, the company’s 2024 revenues and earnings per share would be a far cry from the current consensus estimates of $951.5 million and $1.07, respectively.

Even worse, according to a recent LightReading article, stimulus dollars from the government’s much-touted $42.5 billion Broadband Equity Access and Deployment (“BEAD”) program are now likely to flow later than originally anticipated, which would also put 2025 expectations at risk.

Consequently, I would expect analysts to reduce estimates across the board over the next couple of weeks.

Based on assumptions for no material improvement in the second half of this year and moderate growth resuming in 2025, a valuation of 37x 2025 earnings per share looks rich.

Yahoo Finance / Author’s Estimates

With headwinds potentially lasting well into next year and the stock not exactly a bargain, I see little incentive for investors to buy the drop here.

Bottom Line

Calix, Inc. reported Q1/2024 results largely in line with management’s projections, but for a second consecutive quarter, the company’s guidance fell well short of expectations as larger customers held back on appliance purchase orders.

Adding insult to injury, government rural broadband access stimulus funding might experience delays, thus also putting 2025 estimates at risk.

Consequently, I would expect analysts to reduce projections and price targets across the board over the next couple of weeks.

With current headwinds not likely to abate in the near term and valuation still rich, I don’t see any reason to own the stock here.