Derek Hudson/Hulton Archive via Getty Images

Alpha Metallurgical Resources, Inc. (NYSE:AMR) produces high-quality metallurgical coal. This company has been trucking for the last few years. When coal prices were down, everyone expected coal to be down and out forever. However, the world has continued to consume coal and especially metallurgical coal, which is used in steelmaking.

Increasingly, there are initiatives to replace metallurgical coal in the steelmaking process through hydrogen-based processes, electrolysis, and even recycling can play its role. Aside from that, management has taken sensible actions here and has repurchased stock aggressively when others didn’t see any future for coal and this has had a massive effect on its share price.

In my previous article on Alpha Metallurgical Resources, dating back to December 21st, I advocated for selling a put spread instead of an outright long position, but owning the shares would have worked out fine with a +9% return. Earnings are coming up on 2/26/2024. I’m working on fine-tuning earnings forecasting and figured AMR would be a great subject.

The company beat on earnings 43% of the time over the past 12 events. It beat on revenue 75% of the time. This is an unusual pattern that isn’t typical for most companies. It likely means the company isn’t overly communicative and analysts are having a hard time keeping up. Given the accuracy of revenue (this is above the baseline), there were probably many instances where surprising write-offs or CapEx played a role in how the EPS number came out.

If EPS surprised positively, it was by around 12%, while negative surprises were, on average, by 50%. The positive surprises averaged 11% on revenue, and the negative surprises were more muted at around 5%.

Based on historical earnings data, the odds are fairly high that the company will beat earnings (around 75% or a little bit higher) expected pre-market on February 26th. The odds that the company beats revenue would be lower because it missed last time. However, I made several adjustments to my model.

For example, a few other U.S.-based coal companies already reported. Arch (ARCH) missed on EPS but beat revenue, Warrior Met Coal (HCC) missed both, Consol Energy (CEIX) beat GAAP EPS and beat revenue, and Peabody (BTU) missed earnings but beat on revenue. The revenue beats are likely more informative. I think this is a slight positive for AMR.

In the end, my estimate comes out like this:

FQ4 2023 EPS estimate per share $ Revenue estimate ($ millions) Wall Street Analysts $9.08 $796 Bram de Haas $9.39 $1020 Click to enlarge

Take my numbers with a grain of salt, because I’m still experimenting with prediction models. My revenue beat is fairly large, but that’s because very few analysts work on AMR. The consensus number is made up of only a few guesses.

That’s likely also why the market tends to respond to the reported earnings in a somewhat predictable way. With large companies, there are usually myriad analyst estimates and the company’s fate is well telegraphed ahead of time. It is often the case that I don’t really see a relationship between the important thing (share price response) and the earnings results.

The shares move more on management guidance and color on operations and what it means for future cash flows than how the most recent quarter went.

With this company, historically, the share price increases if the company beats earnings and revenue. It tends to go down if it misses on both. It still increases if it beats on revenue but misses earnings. This makes total sense but that’s often not the case.

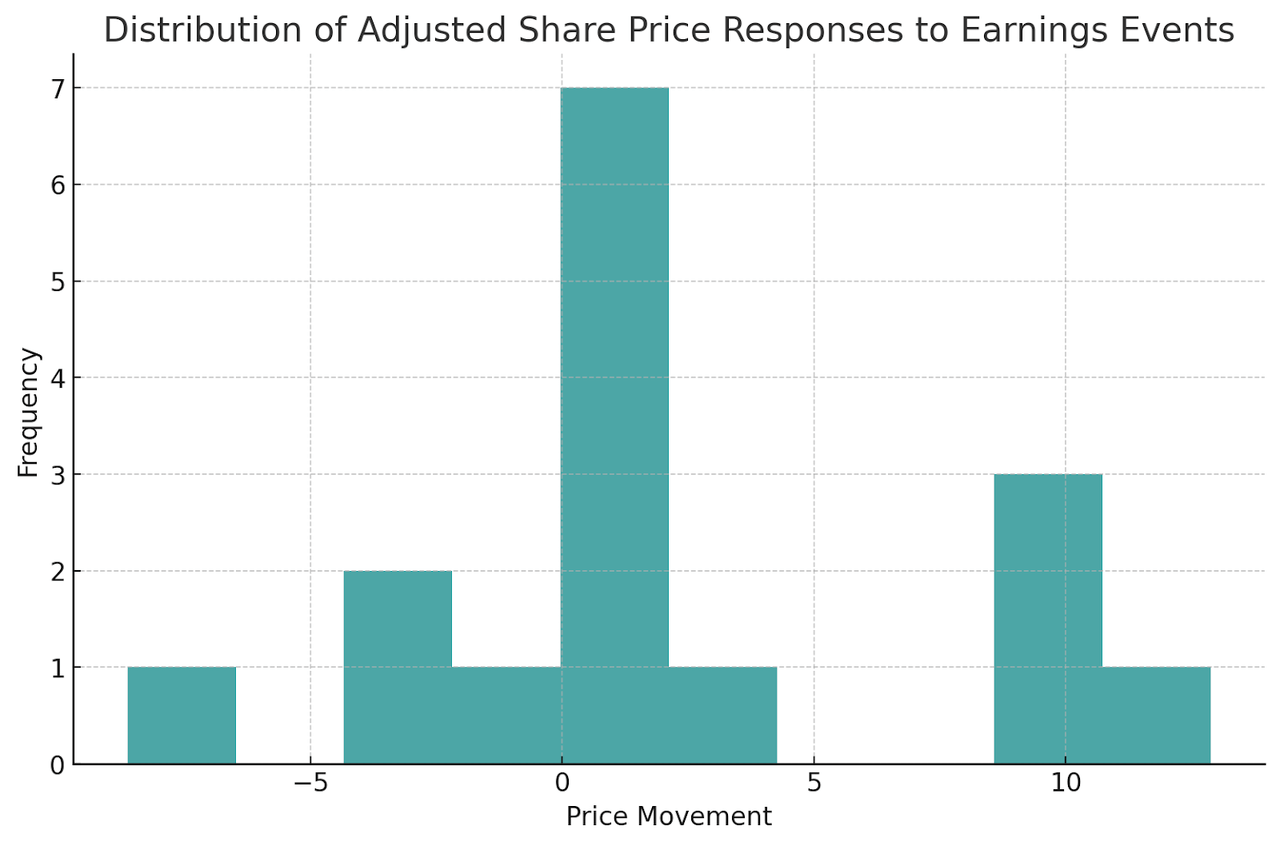

Here is a graph that shows the share price responses to earnings events. I used the closing price on the day before earnings and the open price on the day after earnings:

share price response to earnings (author)

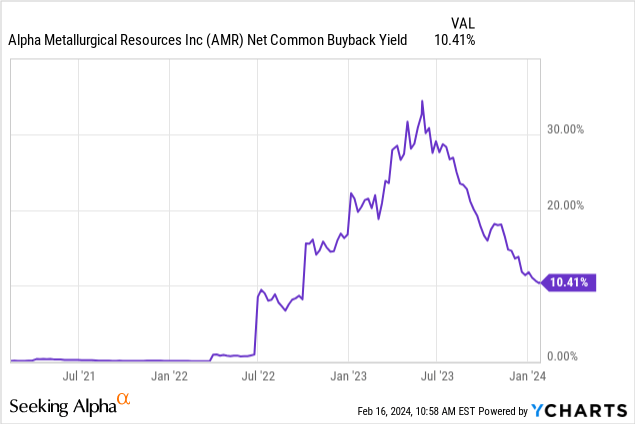

This is a company that really hit the buyback lever hard. At one point, the buyback yield exceeding 30%:

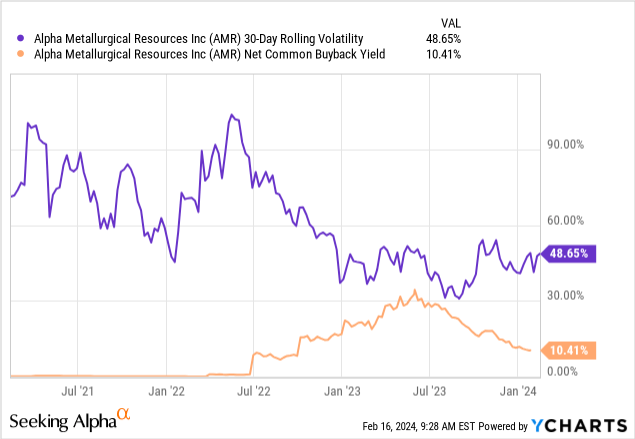

I wondered whether it impacted the volatility of its share price. Here’s a graph of the 30-day rolling volatility vs. the buyback yield:

The implied volatility seems very high if I look at the company’s option chain. I may be missing something. I would prefer to wait until earnings are a little bit closer. Then, it seems relatively attractive to sell the earnings volatility. The average moves aren’t that big, and currently, the $380 straddle goes for $51. That seems very high. Especially given the historical magnitude of price

Source link