jetcityimage

“Travel improves the mind wonderfully, and does away with all one’s prejudices.” – Oscar Wilde

Today, we put THOR Industries, Inc. (THO) in the spotlight. The stock is up over the past 12 months despite challenges across the industry. FY2024 is likely to be a slightly down year from the firm as far as earnings and revenues. However, analysts are expecting strong earnings growth in FY2025. An analysis follows below.

Seeking Alpha

Company Overview:

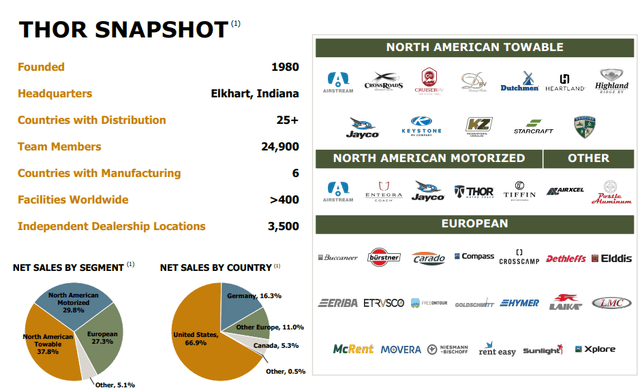

THOR Industries manufactures and sells recreational vehicles or RVs as well as related parts and accessories. Like so many firms in the industry, the company is headquartered in Elkhart, IN. The stock sells for just under $115.00 a share and sports a market capitalization of just north of $6 billion. The company’s fiscal year begins on July 1st. The shares also yield 1.7%, and management has increased annual dividend payouts for 14 straight years now.

January 2024 Company Presentation

The company operates in three business segments: North American Towables, North American Motorized, and then its European Business.

First Quarter Results:

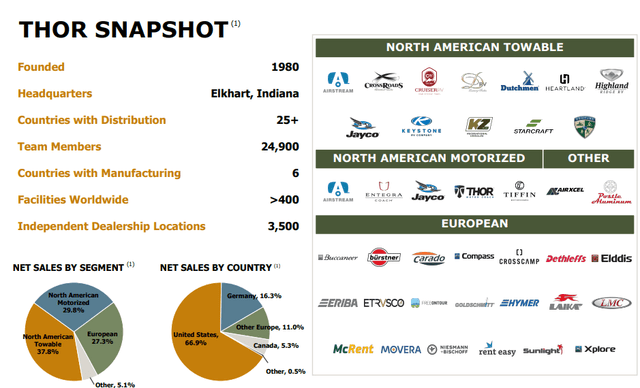

The company posted its 1Q2024 numbers on December 8th. THOR Industries delivered a GAAP profit of 99 cents a share, four pennies a share above expectations. Sales fell over 19% on a year-over-year basis to $2.5 billion, which was roughly in line with the consensus. Gross profit margins fell 140bps from 1Q2023 to 14.3%. Order backlog also fell 27% to $5.36 billion on a year-over-year basis.

January 2024 Company Presentation

Business is down significantly for both North American segments, while growth from Europe was quite robust. North American results were negatively impacted by destocking and also by a shift in the product mix to lower-cost vehicles.

January 2024 Company Presentation

Leadership guided to diluted earnings per share of between $6.25 to $7.25 a share in FY2024, and they project overall revenues to come in between $10.5 billion to $11 billion for the year.

![The 15 Best Python Courses Online in 2024 [Free + Paid]](https://news.pourover.ai/wp-content/themes/jnews/assets/img/jeg-empty.png)