If any Wall Street-listed company represents the ups and downs of China’s economy, it would be Alibaba (NYSE:BABA). You may be ready to load up on Alibaba shares right now, especially if you’re optimistic that China will turn a corner this year. For the very long term, I am bullish on BABA stock, but today, I’m providing a cautionary note due to an imminent make-or-break event.

Alibaba is basically the Chinese counterpart to America’s Amazon (NASDAQ:AMZN). Like Amazon in the U.S., Alibaba is an e-commerce giant in China that is also successful in market niches outside of e-commerce.

Maybe China is on the cusp of an economic comeback of epic proportions; it’s hard to know for sure. Nevertheless, if Alibaba posts positive numbers and provides encouraging guidance in an upcoming earnings report, the bull case for BABA stock could be practically unassailable.

Is Alibaba Stock Too Cheap to Ignore?

First and foremost, I should address an eyebrow-raising comment made by a highly respected analyst firm. Specifically, Barclays (NYSE:BCS) analysts reportedly went so far as to declare that Alibaba stock is “too cheap to ignore.”

Certainly, it’s hard to argue with the “cheap” designation. While American technology stocks soared last year, BABA stock foundered like a sinking ship. Hence, if you truly believe in buying low and selling high, investing in Alibaba should make perfect sense.

Applying traditional valuation metrics seems to support this point. Alibaba’s GAAP trailing 12-month price-to-earnings (P/E) ratio of 10.6x is undoubtedly more appealing than the sector median P/E ratio of 17.51x.

Barclays analyst Jiong Shao also considered Alibaba’s valuation. Observing that Alibaba has generated $27 billion in free cash flow in the last 12 months, Shao assessed Alibaba’s valuation as “among the most compelling.” Furthermore, Shao believes that BABA stock “screens as the cheapest major tech stock globally” and assigned it an Overweight rating.

Story continues

In case that’s not enough motivation for you, here’s another piece of notable news. Apparently, there’s been some serious insider buying going on at Alibaba. In particular, Alibaba co-founder Jack Ma reportedly purchased $50 million worth of the company’s shares.

Not only that, but Alibaba Chairman reportedly bought $151 million worth of BABA stock shares in last year’s fourth quarter. That’s a sure sign of confidence among two Alibaba insiders with deep knowledge about the company.

Traders are Excited About Alibaba, but be Careful Now

Excitement over Chinese tech-related stocks building, but does this mean you have to invest in Alibaba right now? Not necessarily, as waiting could be the most prudent policy.

The excitement isn’t limited to Alibaba but really pertains to Chinese businesses generally. That’s because China’s central bank plans to add $139 billion worth of long-term liquidity to the nation’s economy by reducing the cash reserve ratio for banks. Moreover, Chinese authorities are reportedly looking at a massive $278 billion rescue/bailout/stabilization package.

Consequently, stock traders recently gobbled up shares of Alibaba stock and other China-associated tech stocks. Thus, in the short term, it might be claimed that the forceful measures of China’s central bank have been successful.

On the other hand, it’s too early to simply declare victory and assume that Chinese stocks will continue higher throughout the year. Government intervention in the economy and markets isn’t always the ideal solution to a crashing stock market. For instance, you may recall the time when Chinese authorities restricted short selling in order to prop up the nation’s stock market. This tactic didn’t work well in the long run.

Whether China’s government intervention succeeds in supporting the country’s economy and markets remains to be seen. One could certainly argue that the U.S. stock market has benefited whenever the Federal Reserve pumped liquidity into the banking system. So, maybe this strategy will work in China, with positive ramifications for Alibaba.

That said, it’s probably not an ideal time to jump right into BABA stock. Alibaba has a crucially important earnings report coming up on January 31. It would be quite disappointing if the company breaks its excellent track record of consecutive EPS forecast beats.

The stakes are high, and so are the expectations. Wall Street anticipates that Alibaba will report EPS of $2.73 for the third quarter of Fiscal Year 2024. That’s higher than any quarterly EPS forecast in recent history for Alibaba. Could a major letdown be in store?

Is BABA Stock a Buy, According to Analysts?

On TipRanks, BABA comes in as a Strong Buy based on 18 Buys and two Hold ratings assigned by analysts in the past three months. The average Alibaba stock price target is $118.60, implying % upside potential.

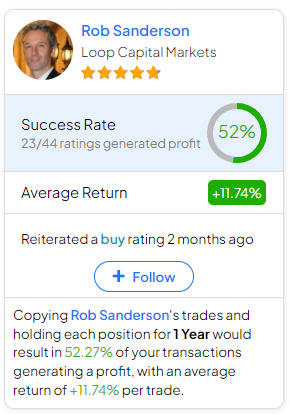

If you’re wondering which analyst you should follow if you want to buy and sell BABA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Rob Sanderson of Loop Capital Markets, with an average return of 11.74% per rating and a 52% success rate. Click on the image below to learn more.

Conclusion: Should You Consider BABA Stock?

I’m bullish on Alibaba’s growth prospects, but only for the very long term. For the immediate term, there’s uncertainty regarding China’s intervention as well as Alibaba’s imminent earnings results. Therefore, I feel that waiting for a little while longer is a sensible policy. Even if Alibaba has the potential to stage an epic comeback in 2024, right now, I’m not ready to consider a share position in BABA stock.

Disclosure