tum3123

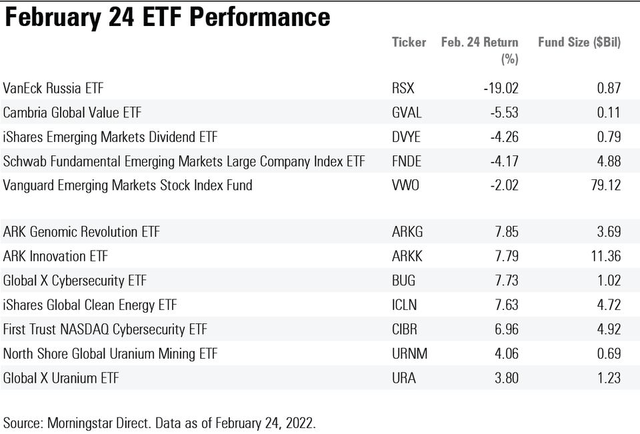

Russia’s invasion of Ukraine resulted in cascading volatility across emerging markets and portfolio management strategies last year. Many Russia-domiciled companies were marked to zero in terms of equity value, hurting ETFs with significant exposure to said firms. One such fund was the iShares Emerging Markets Dividend ETF (NYSEARCA:DVYE). Morningstar noted, back in early 2022, that 16% of its allocation was in Russian stocks, which led to steep underperformance in the first quarter of that year. Know what you own and why you own it, as Peter Lynch would say.

I have a hold rating on DVYE. There’s clearly geopolitical risk with the fund, even with no Russia exposure today.

DVYE’s Sharp Early-2022 Underperformance: Blame It On Russia

Morningstar

According to the issuer, DVYE seeks to track the Dow Jones Emerging Markets Select Dividend Index, offering investors access to a portfolio of high-yielding equities across EM nations. The portfolio typically holds 100 stocks across sectors and styles, and the ETF can be used to form a high-income portfolio strategy. Its annual expense ratio is moderate at 0.49%.

DVYE is a somewhat small fund with just $647 million in assets under management as of December 4, 2023. What stands out is undoubtedly its high 9.3% trailing 12-month dividend yield. Unfortunately, that payout amount can be volatile, and when scanning its dividend growth history, there are ebbs in the distribution – 2021 was the highest annual dividend total at $2.81 while 2022 featured a dip to $2.39.

I encourage prospective investors to investigate other funds with a strong track record of increasing dividends. Still, DVYE sports an A- Dividend ETF Grade by Seeking Alpha and it’s actually a rather low-risk fund when analyzing recent historical volatility metrics. Watch out for liquidity issues at times, though, as I noticed that the ETF’s 30-day median bid/ask spread is high at 12 basis points, so using limit order when trading is prudent. Average daily trading volume is under 100k shares, too.

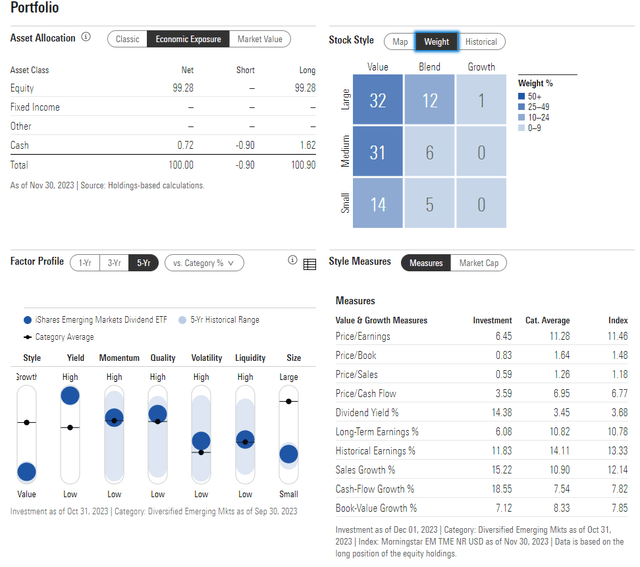

Digging into the portfolio, the 1-star, Neutral-rated fund by Morningstar reveals high exposure to value stocks. There are virtually no Growth positions, while more than half of the allocation is considered small or mid-cap in size. Thus, during periods of perceived economic weakness, DVYE could get hit harder than more defensive portfolios. The upside is that its price-to-earnings ratio is extremely low, near 6.5x (iShares lists it under 6x). The fund is also cheap across other valuation metrics (see below), though long-term earnings growth is not particularly impressive at 6.1%.

DVYE: Portfolio & Factor Profiles

Morningstar

Source link