J. Michael Jones

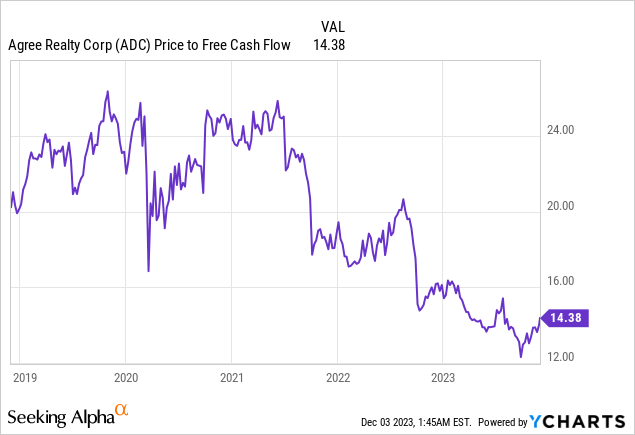

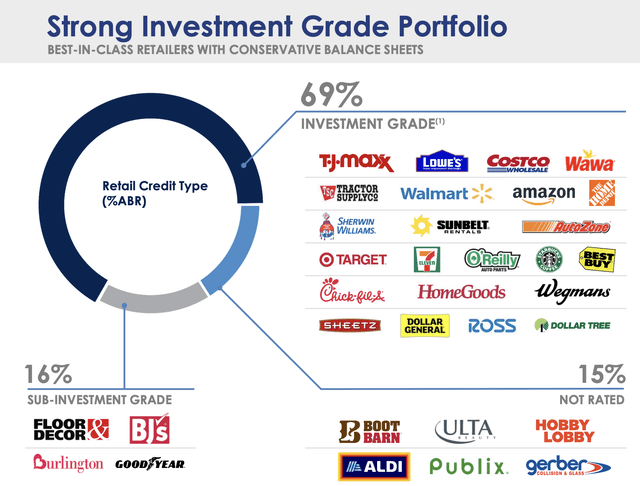

I’ve bought the common shares of Agree Realty (NYSE:ADC) on the back of its growing monthly dividend distributions, its BBB-rated investment grade balance sheet, and the upcoming positive outlook for Fed interest rate cuts. 2023 has not been great for common shareholders with ADC down 15% year-to-date in response to the Fed funds rate being hiked to a 22-year high at 5.25% to 5.50%. This has seen the REIT’s multiple to its free cash flow halved from 2021 highs. Despite recent comments from Powell, the Fed is more than likely done with further interest rate hikes with the CME’s 30-Day Fed Funds futures pricing data now placing a 25 basis points cut as the most likely outcome of the 20 March 2024 FOMC meeting. While this is likely too dovish and expectations for a cut in the first quarter of 2024 will likely be reduced, 2024 stands to see an inversion of a status quo in place since 2022 that has seen REITs suffer a sustained flight of investor capital to competing safer investments. CDs currently offer rates of up to 5.75%.

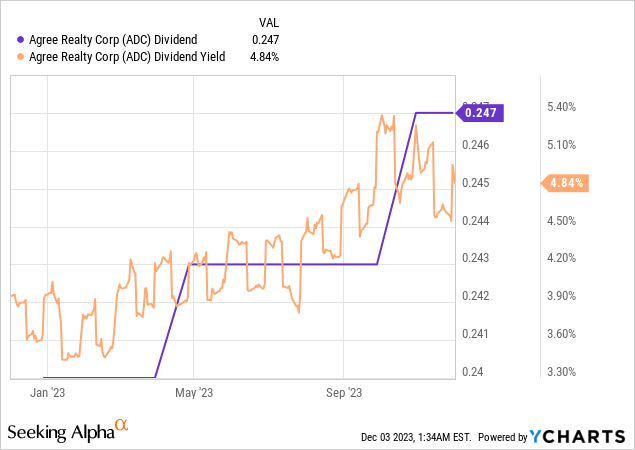

ADC last declared a monthly cash dividend of $0.247 per share, unchanged from its prior distribution for what’s currently a 4.9% annualized forward dividend yield. The current distribution is up 2.9% from a year ago. A recovery of this multiple looks likely as 2024’s base case. To be clear, ADC just bounced off 52-week lows from broader macro expectations that the Fed is done with rate hikes. This dynamic will continue to form the main driver for the direction of REITs until interest rates normalize from current highs. I last covered the ticker in September when sentiment towards the outlook for interest rate cuts was still somewhat negative on higher for longer mantra.

Yield, Growth, And Stability

Agree Realty December 2023 Presentation

Source link