Katie King has interviewed subjects from many walks of business life for her books: academics, venture capitalists, executives from high-profile brands and telecommunications companies. Among them, one that made a lasting impression was an artist: Ai-Da.

King interviewed the artificial intelligence-powered humanoid robot artist for her 2022 book AI Strategy for Sales and Marketing: Connecting Marketing, Sales and Customer Experience. “People are talking about how AI has been the death of creativity,” King says.

In the book, Ai-Da discusses her body of work and life as a celebrity, addressing governments, featuring in a United Nations Exhibition, and having her art shown at the pyramids at Giza.

“She’s contradicting that belief. She\’s talking about some of her incredible work and how she’s gone into palaces and government buildings,” King said. “And actually seeing her in practice, doing her robot artwork, which has a serious environmental impact, dispels that myth that AI can’t be creative.”

At the same time, AI must be subject to rigorous human governance. King points to KFC’s operation in Germany, where a bot programmed to create holiday promotions emailed an invitation to celebrate Kristallnacht—the 1938 Nazi charge that destroyed Jewish businesses and synagogues, leaving almost 100 dead—with a chicken and cheese sandwich.

“Organizations have got boards for human oversight,” and that same governance has to be applied to AI functions, King says. “There are some real horror stories that are out there. Banks and the financial services sector need to be super careful and highly regulated.”

King, formerly the director of agency Text 100—with clients including Microsoft, IBM, Cisco, Nortel and Alcatel—and CEO of Zoodikers Consulting and AI in Marketing—was in Toronto in September to speak to an audience of financial services executives at the SAS Banking Summit dinner during the SWIFT International Banking Operations Seminar (SIBOS).

Cutting through the noise

King says there’s a belief that AI is an “all-knowing” technology that will replace human intelligence, creativity and skill and threaten every human job.

It’s a misconception she wanted to dispel during her visit to Toronto while outlining the very specialized nature of the family of AI technologies beyond the much-hyped generative technology.

She notes that analyst firm Gartner places generative AI at “the peak of inflated expectations” in its hype cycle. In contrast, other forms of AI are approaching the hype cycle’s “plateau of productivity” and being deployed at scale.

For generative AI, Gartner’s “trough of disillusionment” awaits.

“[Generative AI has] reached the mainstream, and the average person and the average employee and multiple organizations really caught on because it is so incredible and so time-saving,” King says. “But the people are starting to say, ‘Well, hang on, we could need to ban our employees from using this.’”

Many companies have banned or severely curtailed the use of ChatGPT, including financial institutions JP Morgan Chase, Citigroup, Goldman Sachs, Wells Fargo, Bank of America and Deutsche Bank. Most cited concerns of the possible unintentional leakage of confidential data.

There are lower-risk applications of AI for financial institutions. Chatbots can handle perhaps 85 percent of routine, low-risk inquiries. The more complex interactions go to a human agent.

King also points out AI’s role in assessing customers’ financial health. TD Bank’s offering of tailored services based on various milestones in customers\’ lives, such as getting married, starting a family, and so on, is just one example.

At SAS Explore in Las Vegas, Bryan Harris, Executive Vice President and Chief Technology Officer at SAS, in trustworthy generative AI.

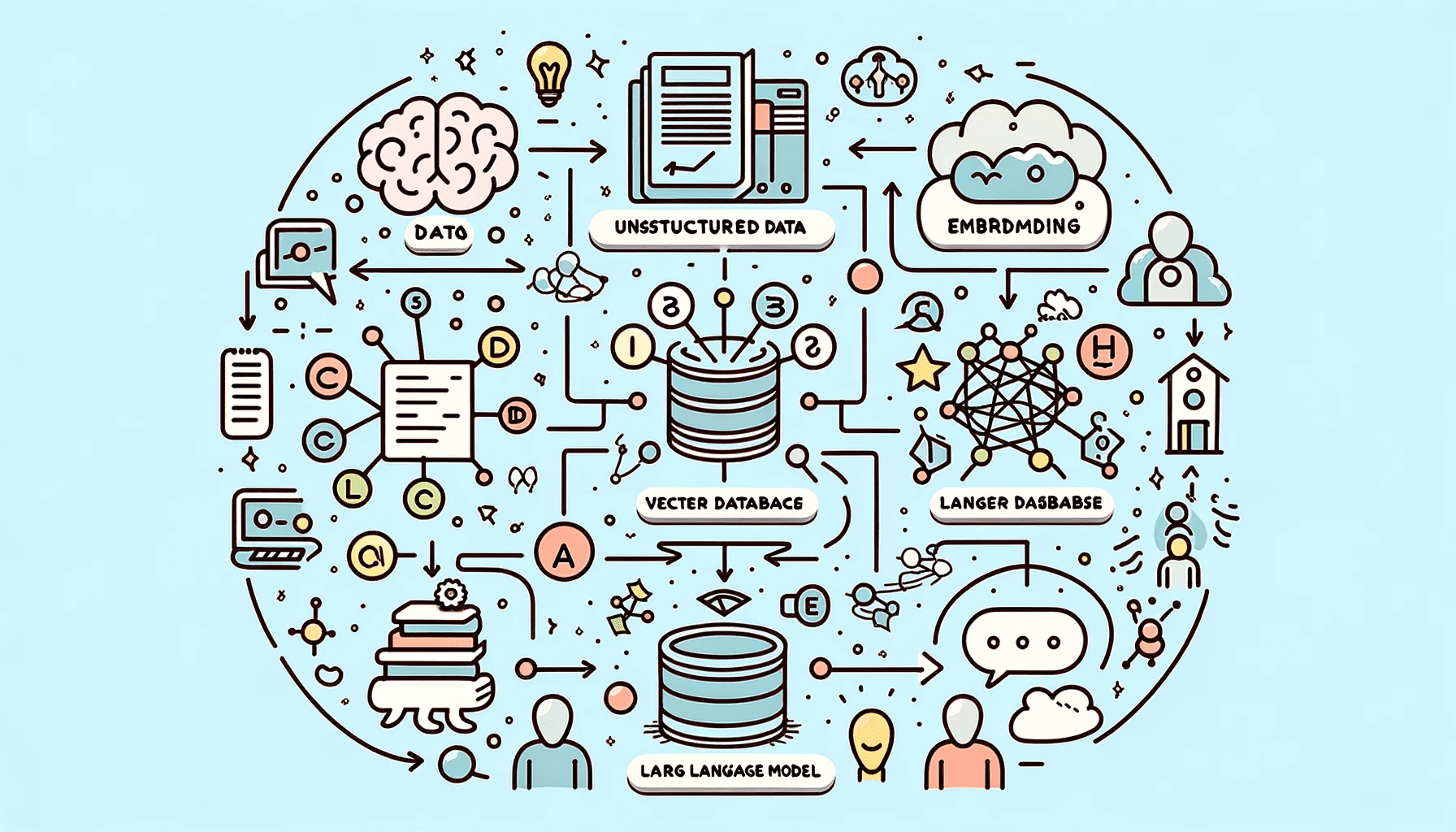

Synthetic data generation: A patented extension to generative adversarial networks (GANs) creates tabular data statistically congruent with complex real-world environments. This allows privacy preservation, bias mitigation, and rare events augmentation. It is the foundation for digital twins (below) and improves predictive modeling in industries like health care, life sciences, banking, insurance, retail and manufacturing.

Digital twins: Organizations can simulate and optimize complex systems like supply chains and manufacturing floors to improve resiliency. Building a digital twin of a physical system allows “what-if” experimentation for more strategic decision-making, increased value, and reduced risk and loss.

Large language models: These foundational models are fine-tuned to industry use cases while preserving data privacy. They draw from expertise in neural networks, deep learning, reinforcement learning and natural language processing. SAS® Customer Intelligence 360 integration incorporates the power of generative AI, helping marketers streamline planning, content creation and journey design.

“Our $1 billion investment in industry solutions includes the integration of trustworthy generative AI capabilities that are accurate, explainable and defendable. SAS® software is often mission-critical to our customer’s businesses, and we don’t have the luxury of being right ‘sometimes.’” Harris said.

King also advocates an international approach to thorny issues of regulation and ethics.

“We can\’t just look at this in a national way,” King said. “You’ve got jurisdictions for the United States, and different states (within the U.S.), and then for Canada and for the EU and UK and others, but many organizations are multinational, I think it\’s really important that we have a multinational approach to this, which is where the G7 and those kinds of treaties and are really important. There’s a really important piece around ethics (and) we have to get that right.”