Yuji Sakai

Since my previous analysis on January 23, 2024 covering Fairfax India Holdings Corporation (OTCPK:FFXDF)(FIH.U:CA) (“Fairfax India”), the situation around Fairfax India has changed significantly, especially on its holding in IIFL Finance. Given the uncertainty ahead for IIFL Finance and Fairfax India despite its support from the parent company, Fairfax Financial Holdings Limited (“Fairfax”), I recommend a “Hold” rating for Fairfax India at this time.

Introduction

Fairfax India is wholly controlled by Fairfax to act as the investment vehicle specifically for India.

Similar to Fairfax, established in 2015, Fairfax India’s objective is to achieve long-term capital appreciation by growing its book value per share through investments in India and Indian businesses.

In 2024 Q1, Fairfax India reported a negative revenue of $282 million (including $411 million in unrealized losses partially offset by $117 million in realized gains) compared to the previous quarter of $206 million. Even though the returns from investing in a developing country are expected to be volatile, this vast difference in a matter of two-quarters of almost $500 million is uncommon.

In addition, Fairfax India’s cash balance decreased from $175 million on December 31, 2023, to just $29.4 million on March 31, 2024.

2024 Q1 is a disastrous quarter for Fairfax India, what happened? We will dive into the details.

IIFL Finance Gold Loans

Fairfax India initially invested in IIFL Group in 2015. On January 31, 2018, IIFL Group was restructured to split into three separate entities, IIFL Finance, IIFL Wealth, and IIFL Securities.

IIFL Finance is a non-bank financial services organization that offers home loans, gold loans, business loans, microfinance, construction and real estate finance, and capital market finance. As of December 31, 2023, IIFL Finance managed about $9.3 billion in assets with the breakdown as follows:

Home Loans (33%) Gold Loans (32%) Microfinance (15%) Loans Against Property (10%) Other (10%)

As of December 31, 2023, Fairfax India’s investment in IIFL Finance was worth $412 million, approximately 11.5% of its portfolio.

The Gold Loans business is one of the fastest-growing segments at IIFL Finance. In 2020 Q2 when Fairfax India started to disclose this ratio, Gold Loans portfolio was just 25% of IIFL Finance’s total assets of $5 billion. It has grown to 32% in just 2.5 years. IIFL Finance’s gold loans portfolio grew from $1.25 billion on June 30, 2020 to $3 billion on December 31, 2023, a growth of 240% in that period.

On March 4, 2024, The Reserve Bank of India (“RBI”), India’s central bank, ordered IIFL Finance to immediately cease activities around its gold loans business after an inspection that identified severe concerns.

On March 4, 2024, IIFL Finance’s stock price collapsed by over 40%. It still hasn’t recovered since then.

IIFL Finance offers loans to borrowers who pledge their gold at IIFL Finance to get funding up to 75% of the pledged gold’s value. However, RBI found that the value of the gold may not have been assessed properly both at the time of sanctioning and at the time of auctioning. The whole point of a gold loan is to use the pledged gold from the borrower as the collateral so that IIFL Finance’s loan asset will be protected in the event of borrower default. When the value of the gold is assessed higher than its actual value at the time of sanctioning, while IIFL Finance thinks its loan-to-value ratio is at 75%, the actual loan-to-value ratio may be at 120%. When the borrower defaults, rather than having a safety margin of 25% given the loan-to-value ratio of 75%, IIFL Finance would be exposed to have to write off at least 20% of the gold loan amount.

In addition, RBI found that IIFL Finance has been conducting an excessive amount of its gold loan business in cash resulting in lack of documentation, traceability and transparency.

In addition, RBI found that IIFL Finance lacks of transparency in various fees charged to its clients around gold loans.

RBI asked IIFL Finance to implement various corrective measures immediately. When ready, IIFL Finance will notify RBI to conduct a special audit. Only if RBI concludes the special audit with satisfactory results, IIFL Finance will be allowed to resume its gold loan disbursements.

RBI initiated the special audit of IIFL Finance on April 23, 2024. IIFL Finance announced to the public that except one measure around the cap of each of its gold loan disbursed, all the other corrective measures have been implemented.

No other banks or financial institutions are currently offering capital to support IIFL Finance pending RBI’s investigation results from the special audit.

While this is causing a significant liquidity crunch for IIFL Finance, this gold loan ban is also a serious threat to IIFL Finance’s entire business and the entire financial services industry in India. As shown in the table below, the crisis at IIFL Finance has brought down other financial services companies’ stock prices significantly, including CSB Bank and IIFL Securities that are also held by Fairfax India.

Fairfax India has pledged to provide up to $200 million capital with IIFL Finance to support its liquidity.

Considering that Fairfax India’s investments are mostly illiquid, the $200 million capital is quite significant and Fairfax India’s current cash on hand is not enough since Fairfax India just paid $110 million cash to Fairfax to settle the performance fees owed for the previous 3-year calculation period from January 1, 2021 to December 31, 2023.

Fortunately, Fairfax India was already planning to sell the entirety of its 70.1% equity stake in the National Stock Exchange of India Limited (“NSE”) in 2023 Q4 and has therefore completed this sale to generate gross proceeds of $132 million. If Fairfax India was only to initiate the sale of NSE after March 4, 2024, it is difficult to believe that Fairfax India can generate proceeds of $132 million amid this crisis.

Depending on the results of the special audit by RBI, the $200 million pledged by Fairfax India may still not be sufficient. IIFL’s total assets were $9.3 billion as of December 31, 2023 with $3 billion in gold loans. If the entirety of the $3 billion gold loans has to be written off by 20%-30%, it is a gap of $600 million to $900 million that Fairfax India alone can’t support. Not to mention, IIFL Finance has no prospect for growth any time soon.

Other than NSE, Fairfax India actually doesn’t have any other assets to be able to liquidate any time soon.

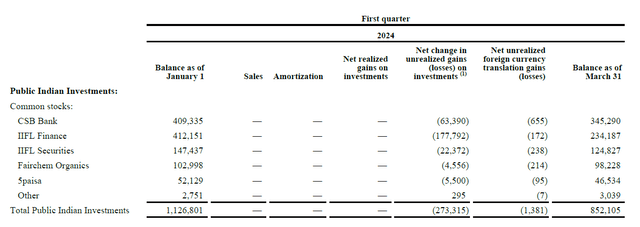

www.fairfaxindia.ca/wp-content/uploads/FIH-Q1-2024-Interim-Report-Final.pdf

From the above table, Fairfax only has about $852 million in public investments that are more liquid. The rest of investments are all privately held companies.

Out of the $852 million public investments, Fairfax India can’t sell its equity stake quickly in CSB Bank due to RBI’s restrictions and it can’t sell IIFL Securities given its close relationship with IIFL Finance. The other holdings are quite small.

It is likely then that Fairfax India may abandon its equity stake in IIFL Finance if the $200 million pledged still can’t restore the trust in IIFL Finance unless Fairfax steps into the rescue.

Of course, on the positive note, if IIFL Finance is able to receive a clean report from RBI on the special audit quickly and restores confidence, Fairfax India’s current and additional investments in IIFL Finance will appreciate in value significantly in the future.

Overall, this special audit by RBI is of vast importance to not only IIFL Finance but to Fairfax India as a whole.

Investors shall be extremely cautious when considering to add position in Fairfax India at this time.

Fairfax India’s other key investments such as BIAL and Sanmar have minimal changes that are worth mentioning in 2024 Q1. To keep in mind, Chemplast Sanmar Ltd’s stock price represents about 74.1% of Fairfax India’s investment in Sanmar. On March 4, 2024, Chemplast’s stock price declined as well, despite that it is in a completely different industry than IIFL Finance. This is primarily why Fairfax India reported $30 million in unrealized losses in Sanmar during 2024 Q1.

Valuation

Fairfax India’s market capitalization is currently at $1.42 billion as of May 31, 2024, representing about 53% of its book value.

Due to the IIFL Finance issue, Fairfax India’s book value per share declined to $19.65 (10% decline) from $21.85 as of December 31, 2023.

Despite the news on March 4, 2024 around IIFL Finance, Fairfax India’s stock price just declined by about 3.5% from $14.68 per share to $14.17 per share on March 5, 2024. It has recovered slightly to $14.3 per share.

Given that Fairfax India’s stock is relatively undercovered, it is not a surprise that the negative news on IIFL Finance has not been fully absorbed by the market.

In the near term, I expect further decline in Fairfax India’s stock price until the results of the special audit and that the prospect of IIFL Finance becomes more clear. However, in the long run, my thesis over Fairfax India still holds that it provides well-needed exposure in India, one of the fast-developing countries in the world, to investors looking to diversify their portfolio.

Conclusion

The situation surrounding Fairfax India has experienced some wild turbulence, particularly due to the complications with IIFL Finance. Despite the backing from Fairfax, the uncertainty, with the ongoing RBI special audit and liquidity crunch at IIFL Finance, requires a cautious approach. Therefore, a “Hold” rating is recommended for Fairfax India at this time. Fellow investors should closely monitor the audit results and subsequent developments, as these will be critical in determining Fairfax India’s future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.