Delek Group Ltd. (TASE:DLEKG) North Sea energy exploration and production unit Ithaca Energy (LSE: ITH) has agreed to acquire Italian energy major Eni unit Eni UK’s North Sea gas and oil assets – one month after announcing talks for the deal.

In this latest acquisition deal, Ithaca will pay $940 million in stock, giving Eni a 37.3% stake in the Delek unit. Delek, controlled by Yitzhak Tshuva, will retain a 52.7% stake in Ithaca, down from almost 90% before the deal. 10% of Ithaca’s shares will still be traded on the London Stock Exchange.

Ithaca currently has a market cap of £1.2 billion ($1.5 billion) while Eni UK was valued at $940 million for the merger. The combined company will have a valuation of at least $2.5 billion. The deal is expected to be finalized by the end of the second quarter of 2024.

Following the acquisition, Ithaca’s production potential (oil and gas) will nearly double to 110,000 barrels of oil equivalent per day from the current 60,000 barrels of oil equivalent per day. Prior to the deal, 70% of Ithaca’s assets were in oil and 30% in natural gas, while Eni UK’s assets are split 60% oil and 40% gas.

Ithaca anticipates that its total reserves after the deal is completed will increase by approximately 100 million barrels of oil equivalent to about 660 million barrels of oil equivalent over a 15-year period. With Eni UK’s reserves lasting 6-8 years, Ithaca’s goal in the deal is to boost production in the short term and generate higher cash flow. Ithaca estimates that after the deal is finalized, it will distribute a dividend of $500 million in each of the next two years.

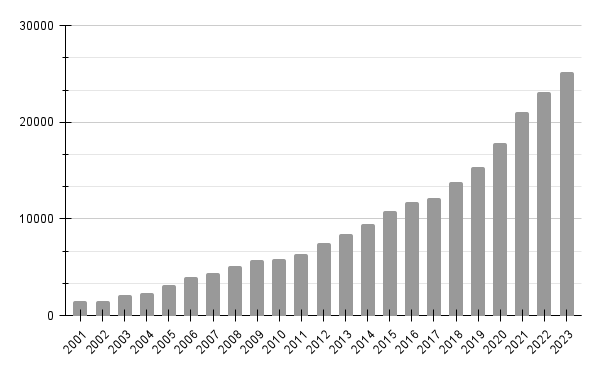

Ithaca went public on the London Stock Exchange in late 2022 with a company valuation of £2.5 billion ($2.9 billion) and has since seen its market cap decrease by 50% to £1.2 billion. Since announcing talks last month to purchase Eni’s UK assets, Ithaca’s share price has fallen by an additional 18%, primarily in the two days following the announcement.

The main reasons for the decline in Ithaca’s share price were the drop in revenue and profit due to falling oil prices, and the introduction of a new oil and gas tax in the UK (referred to as EPL) at a rate of 35% of profits, implemented after the surge in energy prices in 2022.

In 2023, Ithaca reported revenue of $2.3 billion, down 11% from 2022, while profit plummeted by 79% to $216 million. In the same year, Eni UK posted revenue of $980 million and profit of $278 million, down by 42% and 72% respectively from 2022.

The companies believe that the merger will enhance the marketability of Ithaca stock and increase value for the combined entity.

RELATED ARTICLES

Delek unit Ithaca buys Japan’s Marubeni Oil and Gas

Delek Group unit Ithaca to repay it NIS 800m

Jefferies acted as the exclusive advisor to Ithaca in the deal.

Published by Globes, Israel business news – en.globes.co.il – on April 25, 2024.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2024.