Bloomberg/Bloomberg via Getty Images

After Hanesbrands (NYSE:HBI) announced their plans to explore alternatives for their Champion brand last September, recent leaks have pointed to an imminent sale of Champion. This seems to be coming at the behest of activist fund Barington, which recently landed three board seats. While the final result is to-be-determined, let’s take a look at what a sale would mean for HBI.

Background

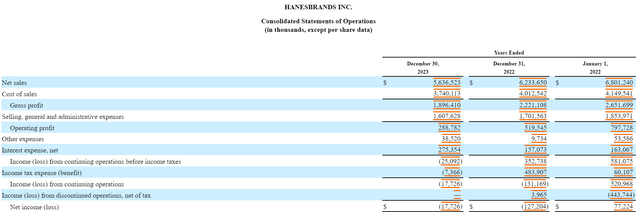

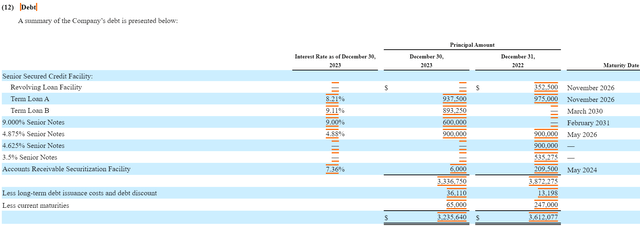

I’m not going into a lot of detail on the history of Hanesbrands, their numerous acquisitions and divestitures, and how they ended up in the mess they are in today. Basically, HBI doesn’t have enough growth and earnings to comfortably carry their current $3.3B debt load:

HBI Income Statement (HBI 10-K)

HBI Debt (HBI 10-K)

As you can see, in 2023 HBI had to roll some very cheap 3.5% and 4.625% notes into 9% senior notes and a 9.11% Term Loan B (SOFR + 3.75%). With their cost of capital going up, and revenues going down, the company is looking to de-lever via the sale of the Champion brand.

The brand in question is driving the most pain at HBI, as Champion sales were down 23% Y/Y in the just-reported Q4-23, versus -1% in innerwear. The company indicated on the conference call that Champion is currently responsible for about $1.7B of global sales (inside Activewear & International segments).

Without a transaction, HBI trades near a $1.6B market cap with $3B of net debt, and guidance of $450m of 2024 operating profit. With over half this amount getting consumed by interest expense, but some continued working capital benefits, FCF guide for 2024 landed at $335m. Not a particularly inspiring valuation, but the continued progress on margins and debt is encouraging.

Perhaps the brightest spot in the Q4 release was noted regarding innerwear market share gains in Q4:

Innerwear sales decreased approximately 1%, or approximately $7 million, as compared to prior year. The Company gained additional market share with both Men and Women during the quarter despite a 5% decrease in the market. The strongest share gains in the quarter were with younger consumers.

On the call the company expounded on how the view the innerwear market:

…the category was down about 3% and then it decelerated a little bit in Q4 to about 5% and we’re expecting a little bit of that continuation into Q4. When you go back and you look at historically, this category has been roughly a 1% unit growth business. And we would expect that the category is going to bounce back to that. You go back and look over the last four years, all the volatility that we’ve had through supply chain and everything that’s gone on, it’s been certainly a volatile couple of years.

The category has actually grown roughly that 1%. I know it doesn’t feel like that, but you’ve had a huge spike of 21, and that’s been down, and our growth during that time’s been about 2%. So, when you look at this in macro, the category’s actually been behaving at historical levels, and we’ve been outpacing that category, and from the beginning we’ve been saying our goal is we’re going to grow two times the category rate, and if you look at it over four years, that’s what we’ve done.

In summary – removing Champion from the equation leaves a stable, boring, yet durable business that has been earning steady operating profits and growing market share. It could be worse.

The Deal

A sale of Champion has been rumored to have a starting price of $1.4B, and Authentic Brands and G-III Apparel (GIII) have been rumored to be in the process. This price point makes sense, given that struggling global brands like Reebok have recently transacted around 1x sales.

Without more specific disclosures from the company, analysts are left guessing what exactly a Champion-less HBI will look like.

Broad strokes, I expect the following based on the HBI guide and historical results:

International + Activewear was $3B of revenue in FY23 and $230m of operating profit (with around $1.7B of Champion sales inside). My impression from Management comments is that Champion’s contribution has been minimal. I’m assuming $130m of FY23 contribution from the brand, despite its recent challenges. Innerwear operating profit improved Y/Y in 2023, but that and 2022 were their only years historically with sub $500m operating profit since 2013. The company has guided to continued margin improvement here, and I expect they can return it to a $500m business. Unallocated corporate expenses have run at $200m+ for the past two years, but my understanding is that Champion requires more infrastructure to manage than their innerwear business. I am going to assume about $50m of cost takeout is possible here after a sale, though I am suspicious the actual result may be higher. As a point of reference, Gildan (GIL) runs with SG&A at 10% versus nearly 30% at Hanesbrands. There should be plenty to cut after a divestiture simplifies the business. With a divestiture of $1.5B and guidance of $300m or so in 2024 debt paydown, Champion should be exiting 2024 with about $1.5B of gross debt, which would result in around $125m of interest expense. FY24 guidance of $75m of CapEx assumes some investment in Champion, so I’ll assume $50m for RemainCo.

In summary:

$500m Innerwear Operating Margin +$100m Remaining International/Other -$150m Corporate expense $450m New HBI EBITDA -125m Interest -$50m CapEx $325m FCF

For a $3.1B EV, this is 6.9x EV/EBITDA, 9.5x EV/FCF, and a whopping 20.3% FCF yield to equity. I don’t think an innerwear business growing below GDP deserves a fat premium, but if post-sale guidance from HBI lands in the above range, it’s a very attractive investment. The above metrics would allow for the return of a chunky dividend, buybacks, and/or debt paydown.

Risks

Champion isn’t sold, and HBI has to de-lever slowly from FCF and execute their own turnaround of Champion

Post-sale Champion guidance is worse than outlined above

Global conditions worsen, cutting demand for innerwear and activewear products

Apparel is a tough sector, even the boring categories

Main competition comes from Berkshire-backed Fruit of the Loom

Conclusion

I think recent news around the potential sale of Champion by HBI deserves more attention, as it may allow for the company to operate with a leaner capital stack, less interest expense, and better FCF conversion. I’ll be watching for further news as the sales process draws to a conclusion, and am hopeful for a positive outcome for HBI.